Reviewed by Helen Kollias, PhD and Brian St. Pierre, MS, RD

At some point in my mid-40s, the scale started climbing.

A pound or two turned into five, then 10, then 20.

It seemed as if I was doing all the right things: Eating less, moving more, rinse, repeat. Yet, the harder I worked, the less the scale seemed to respond.

Had perimenopause destroyed my metabolism?

It sure felt like it.

However, after asking my doctor to run a series of tests, I learned that my metabolism was, in fact, fine. Instead, like the vast majority of midlife women, the true causes of my weight gain stemmed from several subtle issues that I would have sworn, at the time, didn’t apply to me.

If, like me, you or your client are currently stuck in what feels like an eat less, gain more cycle, this article is here to help.

In this story, you’ll discover:

- Several reasons women gain weight at midlife that have nothing to do with a “slower metabolism”

- Why intense exercise and strict diets can backfire after menopause

- 11 crafty ways to get a handle on midlife weight gain

First, what is menopause?

Many women refer to midlife hot flashes and inconsistent menstruation as “being in menopause” or “menopausal.”

However, menopause isn’t a phase as much as a transitional moment that separates menstruation from non-menstruation.

Once you’ve gone 12 consecutive months without a period, you’ve reached menopause. For most people, that moment arrives somewhere between ages 46 and 56.

The hot-and-dewy months and years leading up to that 12th missed period are technically known as “perimenopause.”

Perimenopause means “around menopause.”

Some people refer to this time as the menopause transition. This is when estrogen levels fluctuate. Menstrual cycles lengthen and shorten and, at times, disappear, only to return a few months later. For many people, this marks the beginning of symptoms like hot flashes, sleep issues, vaginal dryness, mood changes, and, yes, creeping weight gain.

(For a thorough overview of the many changes that can happen during this time, read: ‘What’s happening to my body!?’ 6 lifestyle strategies to try after menopause)

How much weight do women gain during menopause?

Many women think of menopause and weight gain the same way many young parents think of two-year-olds and tantrums: Inevitable.

However, not all women gain weight during the menopause transition, explains Helen Kollias, PhD, who is an expert on physiology and molecular biology, and a science advisor at Precision Nutrition and Girls Gone Strong.

On average, in the West, women gain four to six pounds during the three-and-a-half years of perimenopause, or about one to two pounds a year.1 2

That’s double the rate of weight gain in pre-menopausal women, though it’s roughly the same amount men gain at midlife, notes Dr. Kollias.

In other words, the menopause transition may not be solely to blame for those extra pounds on the scale. Aging may play a significant role, as we explore below.

The real reasons the scale climbs

Several factors conspire to add pounds to your frame during the menopause transition.

✅ You’re not sleeping as well.

Maybe this sounds familiar: You wake repeatedly with sweat pooling under your breasts and sheets that are uncomfortably damp (or soaked).

Even if you don’t have night sweats, plenty of other issues might keep you awake.

First, there’s worry—over aging parents, teenagers with car keys, money needed to replace that leaking roof, some strange bodily sensation you’re worried might be cancer, the colonoscopy or mammogram you don’t want to schedule but also don’t not want to schedule, the sex you’re not having, and so many others.

Plus, if you’re like me and you have osteoarthritis in multiple joints, your body hurts. Or your skin might itch. Or your legs are restless. Or you’re bloated.3 4 5 6

My point: Problems that make sleep uncomfortable can multiply with age.

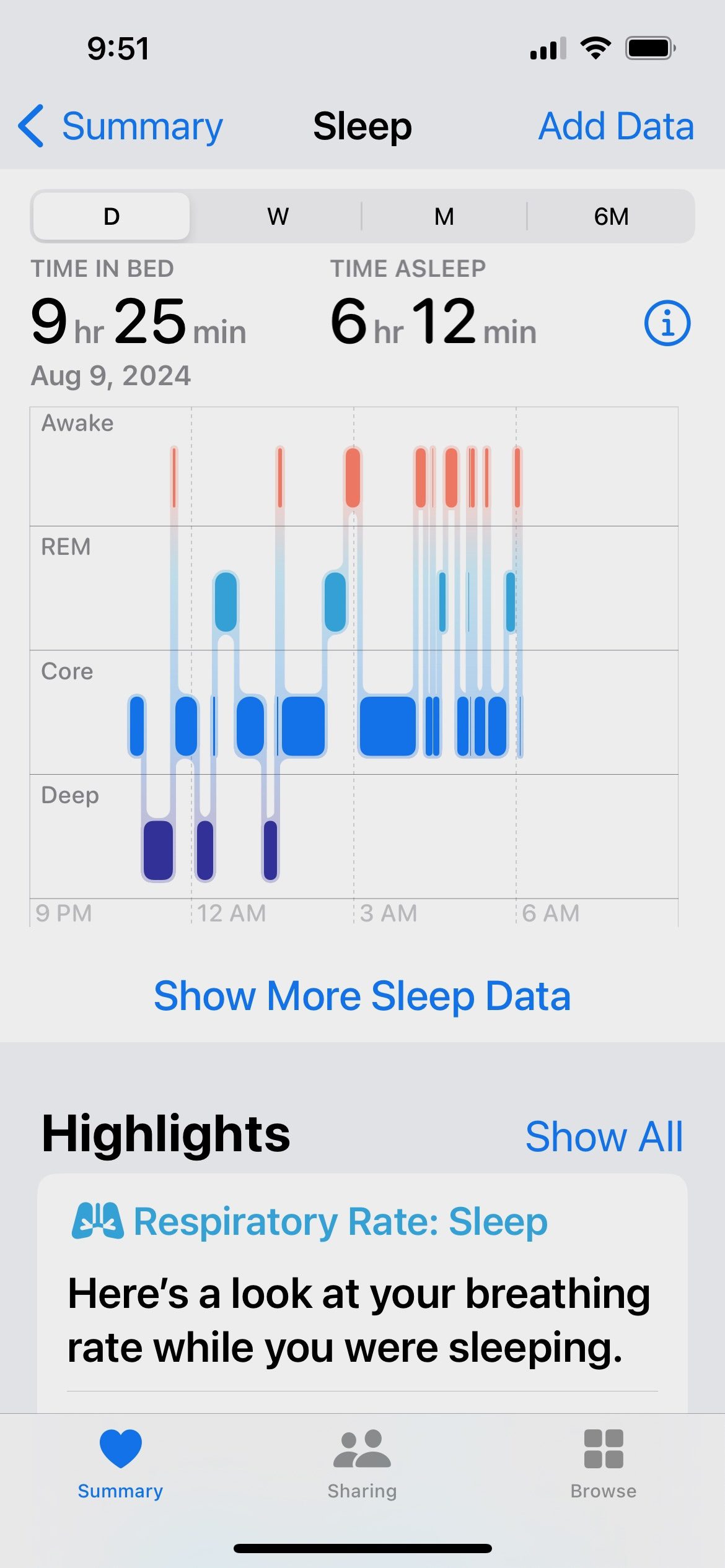

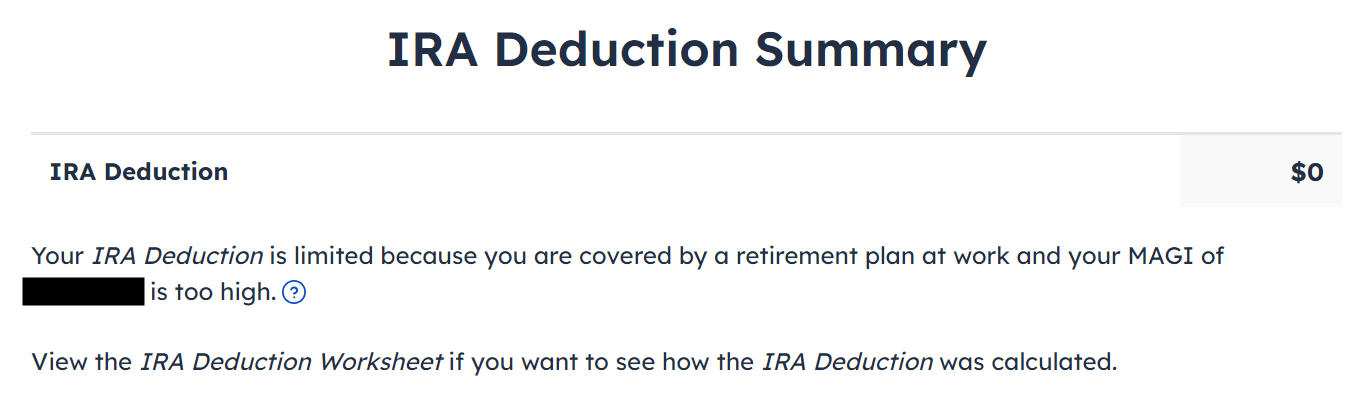

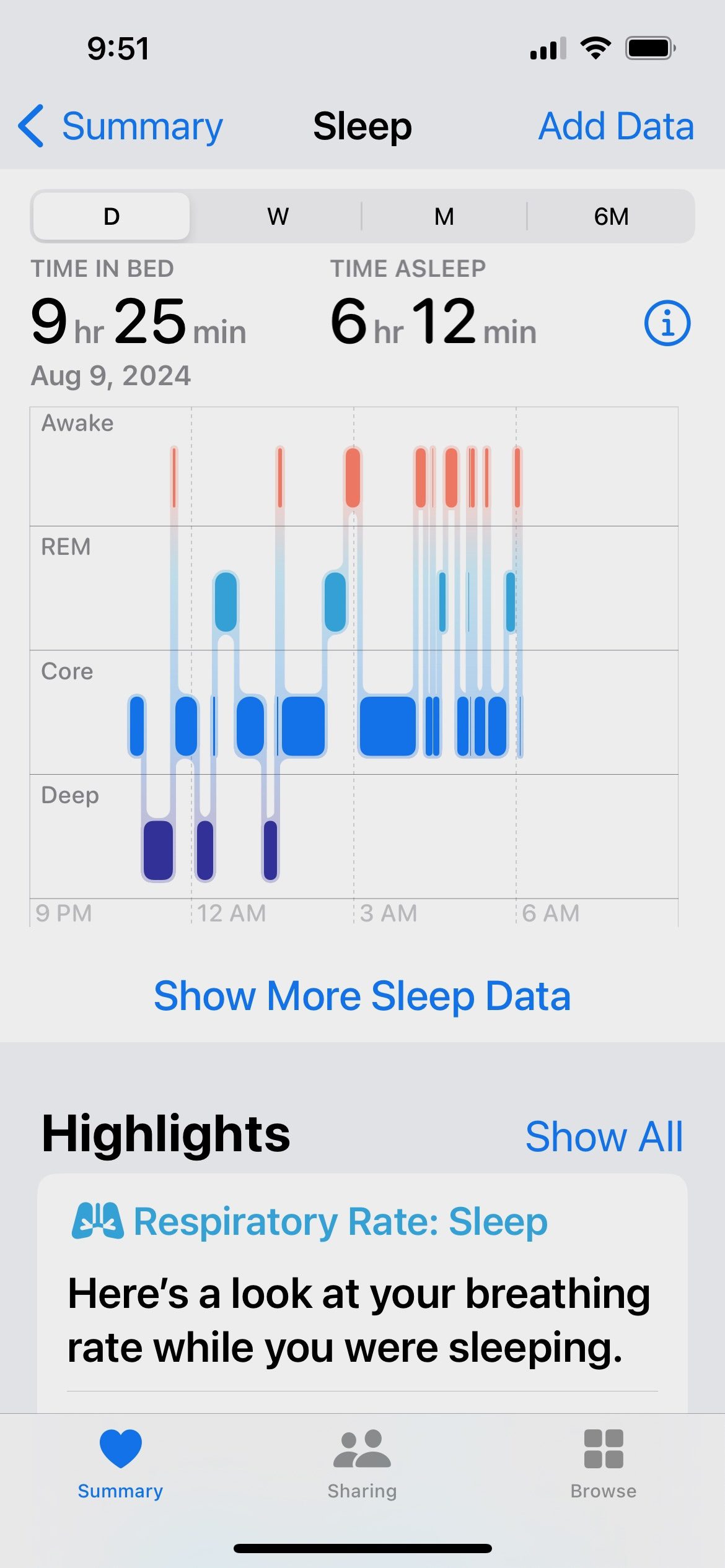

Because of this, I’ll sometimes wake four or more times a night, as the red sections of this readout from my smartwatch show.

These bad nights often set up a vicious cycle:

The following day, I feel as if I’m two inhales away from death. So, I keep myself going with caffeine, which makes the next night just as bad or worse.

Lack of sleep indirectly adds pounds to your frame in several ways:

- When you’re sleep-deprived, it’s harder to cope with negative emotions, which may mean you turn to food for solace.

- In addition, your decision-making gets compromised, so it’s harder to choose an apple when a chocolate chip cookie is also available.

- Plus, sleep deprivation intensify both appetite and cravings (which we’ll discuss more in the next section)

(Want to get a handle on some of the sleep challenges unique to this transition? Check out: How menopause affects sleep, and what you can do about it)

✅ You’re hungry, and not for celery.

True story: When I was in my early 30s, someone once told me about her intense cravings, and I thought, “Cravings? What are those exactly?”

(Don’t hate me.)

Those days now feel foreign to me. Post-menopause, I spend most of my morning wondering how soon I can eat lunch, what I might have for lunch, whether it’s okay to have a snack now, and, if so, what it should be.

After lunch, I go on to spend the afternoon thinking about dinner.

It’s as if my appetite never flips off.

For the longest time, I thought something was wrong with my brain or metabolism.

It didn’t occur to me that the increased hunger, appetite, and cravings likely stemmed from my repeated awakenings each night.

Until I checked out the research.

In one study, people who were sleep-deprived reported higher levels of hunger and a stronger desire to eat. When provided access to snacks, they consumed twice as much fat compared to days when they weren’t sleep-deprived.7

In another study, when healthy, young study participants slept four hours a night, they consumed 350 more calories the following day.8

The annoying cycle of weight and food preoccupation

Hormonal transitions (puberty, pregnancy, menopause) often cause changes to women’s body shape and size.

Sometimes that’s welcome (“Ooh, a butt!”) and sometimes it’s not (“Darn, a butt!”).

Some women—like me—don’t worry too much about their weight or body shape. Then, we gain unexpected (and unwanted) pounds, and with that, a new (also unwanted) preoccupation with the scale.

Many women also find that as they try to get a handle on the scale, their preoccupation with food may (frustratingly and paradoxically!) shoot upwards—especially if they turn to restrictive diets or food rules for a solution.

Interestingly, this preoccupation with food can occur whether or not someone is actually reducing their calorie intake. In other words, this phenomenon can happen when someone just thinks about reducing their food intake.

The phenomenon has a name: It’s called cognitive dietary restraint (CDR), and it can create a frustrating cycle of body image dissatisfaction, food preoccupation, and stress.

In one study, people who used a low-carb, intermittent fasting protocol to lose weight reported more frequent episodes of binge eating and more intense food cravings.9

In another study, postmenopausal women who scored high in CDR excreted more of the stress hormone cortisol than women who scored lower in this measure.10 Higher levels of CDR in pre- and postmenopausal women were even associated with shorter telomeres, a sign of accelerated aging.11

All this to say, leaning too hard into self-criticism and extreme dieting can backfire. Which is why the strategies we suggest later in this article focus more on adding more nutritious, appetite-regulating foods, and prioritizing things like mindfulness and movement.

With these approaches, you’ll be less likely to feel deprived, and more likely to feel satisfied—and hopefully, empowered.

✅ You’re moving less.

As humans age, we develop chronic low-grade inflammation and weakened immune function. When combined with the crummy sleep we mentioned earlier, along with other biological changes, this can interfere with the body’s ability to recover from intense exercise.

The result: If you do too many vigorous workouts too close together, you’ll start to feel run down, sore, and unmotivated.12 13 14

Other issues that crop up around midlife can also interfere with movement, like chronic injuries or joint pain.

(A personal example: Due to osteoarthritis in my feet and spine, I switched from running to walking. This is easier on my body, but isn’t as efficient at burning calories.)

Finally, due to those pesky time-sucks known as full-time jobs and caregiving responsibilities, you might not be as active in your 40s and 50s as you were during your 20s. Plus, over the past few decades, multiple inventions (hello, binge-watching) have conspired to keep people on the couch and off our feet.

So, can you blame your hormones for anything?

Other than messing with your sleep which, in turn, messes with your appetite and energy levels, fluctuating estrogen and progesterone likely aren’t behind your extra pounds—at least, not directly.

If they were, menopause hormone therapy would help people stop or reverse weight gain. (It doesn’t.15)

However, shifting hormonal levels are responsible for where those extra pounds appear on your body. As estrogen levels drop, body fat tends to migrate away from the thighs and hips and toward the abdomen, even if you don’t gain weight

Old tactics may stop working after menopause

The “Rocky” weight loss method was my go-to when I was younger.

Whenever I wanted to drop a few pounds, I imagined I was a character in one of those “couch potato gets super fit” movies.

In addition to walking and running, I embraced the sweat-til-you-vomit workout du jour. (Remember Tae Bo?) I also cut out foods, food groups, or entire macronutrients. A couple of times a week, I skipped lunch or dinner.

It worked.

Until, of course, it didn’t.

Now, whenever I push too hard in the gym, I either get injured or feel so unbelievably tired that I must take four days off from all forms of movement. If I try to do anything extreme with my diet, I eventually eat every crunchy or sweet thing I can find, including stale crackers.

For these reasons, after midlife and beyond, the countermeasures for weight gain aren’t strict diets (looking at you, intermittent fasting) or barfy workouts.

Instead, to limit weight gain after menopause, you need to get wise about finding ways to tip calorie balance in your favor without triggering overpowering hunger, cravings, and fatigue.

Regardless of age or stage, fundamental nutrition and fitness strategies still apply—and work.

What changes after menopause is how you tackle these fundamentals.

Experiment your way to better results

The best menopause plan will look different for each person.

That’s why experiments are so important.

Precision Nutrition coaches often use experiments to help clients discover essential clues about what they need (and don’t need) to reach their goals. Based on the results you get from each experiment, you can make tiny tweaks, test them, and decide whether they work for you—until you find something that does work for you.

How to run an experiment

Health experiments are no different from the scientific method you learned about in middle school.

- Choose a question to answer, such as, “Would I feel less munchy at night if I ate a protein-rich snack every afternoon?”

- Run an experiment to test your question. In the above example, you’d track your hunger and cravings before adding the snack—to get a baseline—and then continue to track them for a couple weeks after adding the snack.

- Assess what you learned. Did your ratings of hunger and cravings drop? Remain the same? Go up? What about your actual nighttime food consumption? This information can help you determine your next steps.

Below are 11 experiments worth trying during and after menopause. We’ve separated them into three categories: sleep, hunger, and energy.

(And if those 11 options aren’t enough, we’ve got more ideas here: Three diet experiments that can change your eating habits)

Experiments for improved sleep

Below, you’ll find a mere smidge of the many sleep tweaks you can try and test. For more ideas on potential sleep experiments, check out our 14-day-sleep plan and story about cognitive behavior therapy for insomnia.

Experiment #1: Reset your body’s circadian clock

As you age, your body starts to behave like an old clock that continually runs slow.

Even if you used to be a morning person, you might wake groggy, as if your body doesn’t know it’s morning. Or, your body might tell you “time for bed” at weird times, like the middle of the afternoon. Then, after spending several hours fighting the urge to nod off during work meetings, you find that, when it actually is bedtime, you’re staring at the ceiling in the dark.

This is why it’s helpful to experiment with zeitgebers, which are environmental and behavioral time cues that help to set your body’s internal circadian clock.

These experiments might include the following:

- Get up at the same time every day, regardless of how you slept the night before.

- Spend 10-20 minutes in the sunlight as soon as possible after you wake.

- Take a cold shower at the same time each morning or a hot shower or bath at the same time each evening.

- Get outside frequently during the day, especially whenever you feel sleepy.

- Exercise at the same time daily. Try first thing in the morning or 4 to 6 hours before bed. Bonus points if you do it outdoors.

- Eat meals, especially breakfast, at the same time every day.

Experiment #2: Remove “I’m uncomfortable” from your sleep vocabulary

How you run this experiment will depend on what’s causing discomfort. We’ve listed a few possibilities below.

- If you tend to wake feeling uncomfortably hot: Experiment with cooling technology. This might range from the very affordable, such as turning the thermostat a degree or two cooler or using a fan, to the more expensive, such as cooling electric mattress pads.

- If you wake feeling bloated: If you’re constipated, try some prunes, a small daily serving of beans, a little psyllium fiber, or just extra water to get things moving. Or, you might try consuming a smaller meal or avoiding fatty foods in the evening.

- If an uncomfortable “I need to move” sensation creeps into your legs at night: Talk to your doctor about restless legs syndrome, a condition that tends to worsen with age and/or iron deficiency. A physician may also give you ideas to cope if itchy skin or joint pain is keeping you up.

Experiment #3: Time caffeine strategically

We know we’re almost picking a fight with this suggestion. However, it’s worth investigating, especially if you consume caffeine in the afternoon or evening.

If you’re like most people, it will take your body about five hours to clear half the caffeine from your system. That means about half of your 4 p.m. latte is still energizing your system at 9 p.m.

But here’s the thing: Some people metabolize caffeine much more slowly than others, taking roughly twice as long to clear it from their bloodstream.16

Interestingly, even if you had no issues with caffeine when you were younger, you might have issues now, as caffeine clearance tends to slow over time.17

To see if caffeine is a problem, you’ve got a couple of options.

- Try slowly shifting your consumption earlier by 30 to 60 minutes. (If you usually have your last coffee at 4 p.m., cut yourself off at 3 p.m., then 2 p.m., then 1 p.m., then noon.)

- Switch to a lower caffeine source. (Try a bean blend that’s half decaffeinated. Or, you could switch to a lower-caffeine beverage such as green tea or maté.)

(Yet more solutions to common problems: The five top reasons you can’t sleep)

Experiments to reign in hunger

The tactics below likely won’t surprise you. After all, they form the bedrock for solid nutrition and good overall health.

However, before you disregard them with a “been there, done that!” consider: How many of the below are you actually doing consistently?

Experiment #1: Add a protein serving

It may seem counterintuitive to add a serving of food to your meals when you’re trying to eat less.

However, this one tactic may help reign in appetite and hunger.

Protein takes longer to digest than does carbohydrate or fat, so it helps you feel full and satisfied for longer.

In addition, you may find, as I did, that you’re not consuming anywhere near as much protein as you think. (Find out how much you need here: ‘How much protein should I eat?’ Choose the right amount for fat loss, muscle, and health)

Try one or both of the following:

- Consume at least 1 to 2 portions of lean protein at every single meal

- Prioritize snacks that contain protein—hard-boiled eggs, turkey sausage links, Greek yogurt, cottage cheese—instead sweets or chips.

Experiment #2: Choose high-fiber carbohydrates over lower-fiber ones

Fibrous plant foods can help fill you up with fewer calories.

To see the difference, you might monitor how you feel after consuming a near-zero-fiber food, such as your favorite assortment of snack chips. The following day, when it’s time for the same snack or side dish, opt for something with more fiber, such as roasted nuts, a side of beans, a salad, or a piece of fruit. Notice how the fiber-rich option affects your appetite and hunger for the next few hours.

Another experiment worth trying: Include one to two portions of produce with every meal you consume. Track your sensations of hunger to see if they make a dent.

Experiment #3: Log between-meal indulgences

You may be reaching for more snacky foods and beverages than you realize.

These foods don’t need to be 100 percent off-limits; you just want to be intentional about your consumption and portion sizes.

For a couple of weeks, keep track of alcohol, sweets, and treats that you eat between intentional meals and snacks.

Review your notes at the end of each day to see if these more impulsive or less mindful eating episodes align with your memory of what and how much you consumed.

Experiment #4: Move after meals

Increased inflammation coupled with decreased muscle mass, among other factors, leads many people to become more insulin-resistant with age.18 Cells don’t respond as readily to the hormone, which means more glucose stays in the bloodstream rather than entering cells that can use it for energy.

Through a complex set of mechanisms, this can drive up hunger and overall appetite.

Consuming protein- and fiber-rich meals will help, as we mentioned earlier.

So will movement. Walking for as little as two minutes after meals can help your body process the carbohydrates you consumed, improving blood sugar levels, finds research.19 20

In addition, by removing yourself from your kitchen, you create a habit that helps to psychologically shift you away from “eating” and over to “the kitchen is closed.”

Experiments for more energy

To address midlife brain fog and fatigue, you’ll want to do all you can to encourage good sleep. In addition, see if the below suggestions make a difference.

Experiment #1: Prioritize strength training over intense cardio

This was a hard lesson for me because I love intense cardio.

However, now in my 50s, if I try to fit in two weekly strength training sessions and two weekly spin sessions, I feel drugged—as if someone spiked my coffee with tranquilizers.

When my Precision Nutrition health coach suggested I dial back on the cardio for a couple of weeks, I won’t lie. I thought about firing her.

But then I took her advice and rediscovered what it felt like to be alert.

Don’t get me wrong: I still do cardio. But I’m smart about it. I now know that I can’t do everything, at peak intensity, and expect to feel rested and alert daily. There’s a balance.

Strength training is increasingly important at midlife to protect bone strength and maintain muscle mass. Aim for at least two weekly sessions. Then, fit in cardio around those sessions.

If you feel worn out, experiment with doing low- or moderate-intensity cardio (like brisk walking, slow cycling, or swimming) over higher-intensity cardio (like an hour-long spin class).

Or, if you love higher intensities, keep doing them, but shorten your duration.

Or, just save those vigorous sessions for when you got great sleep the night before.

Experiment #2: Try active recovery

Active recovery can help increase blood circulation and the removal of waste products that may have built up in your muscles during intense exercise sessions.21

This can include light activities such as walking, swimming, yoga, or stretching. You can also try massage, foam rolling, or a long, hot bath.

Experiment #3: Consider creatine

Lots of folks think of creatine monohydrate as something people take to get jacked.

However, more and more evidence points to creatine’s benefits for people in midlife and beyond.

The supplement may be especially helpful for muscle recovery.

In research that pooled the data from 23 studies, study participants who took creatine experienced fewer indicators of muscle damage 48 to 90 hours after intense training than participants who didn’t supplement.22

The supplement may also help you to think clearly, especially after a bad night of sleep, finds other research.23

Finally, by promoting cellular energy throughout the body (including the brain), creatine may help to blunt fatigue and boost mood.24 25

A daily dose of three to five grams works for most people.

The winning midlife mindset

There’s one final experiment that I want to tell you about.

It has to do with embracing a mindset of acceptance.

Think back to other difficult phases of your life. For me, parenting an infant with colic comes to mind. Gosh, I was so tired back then that I likely would have forked over my entire 401k in exchange for one solid night of sleep.

However, I knew that the stage was temporary. That knowledge helped to keep me going.

Midlife can be similar.

You likely won’t weigh at 55 what you did at 25. That’s okay. However, the night sweats, brain fog, and fatigue are all fleeting. You will eventually establish a new normal.

In the meantime, see if you can accept that your body may look and feel different now. Shift your focus away from trying to look and feel like your younger self and toward consistently embracing new behaviors that will help you age with strength, vitality, and contentment.

After all, you have much more control over your behavior than the number on the scale.

References

Click here to view the information sources referenced in this article.

- Knight MG, Anekwe C, Washington K, Akam EY, Wang E, Stanford FC. Weight regulation in menopause. Menopause. 2021 May 24;28(8):960–5.

- The Royal Australian College of general Practitioners. Australian Family Physician. [cited 2024 Aug 11]. Obesity and weight management at menopause. Available from: https://www.racgp.org.au/afp/2017/june/obesity-and-weight-management-at-menopause/

- National Institute on Aging [Internet]. [cited 2024 Aug 10]. Sleep Problems and Menopause: What Can I Do? Available from: https://www.nia.nih.gov/health/menopause/sleep-problems-and-menopause-what-can-i-do

- Feng J, Luo J, Yang P, Du J, Kim BS, Hu H. Piezo2 channel-Merkel cell signaling modulates the conversion of touch to itch. Science. 2018 May 4;360(6388):530–3.

- Fourzali KM, Yosipovitch G. Management of Itch in the Elderly: A Review. Dermatol Ther. 2019 Dec;9(4):639–53.

- National Institute of Neurological Disorders and Stroke [Internet]. [cited 2024 Aug 10]. Restless Legs Syndrome. Available from: https://www.ninds.nih.gov/health-information/disorders/restless-legs-syndrome

- Hanlon EC, Tasali E, Leproult R, Stuhr KL, Doncheck E, de Wit H, et al. Sleep Restriction Enhances the Daily Rhythm of Circulating Levels of Endocannabinoid 2-Arachidonoylglycerol. Sleep. 2016 Mar 1;39(3):653–64.

- Covassin N, Singh P, McCrady-Spitzer SK, St Louis EK, Calvin AD, Levine JA, et al. Effects of Experimental Sleep Restriction on Energy Intake, Energy Expenditure, and Visceral Obesity. J Am Coll Cardiol. 2022 Apr 5;79(13):1254–65.

- Colombarolli, Maíra Stivaleti, Jônatas de Oliveira, and Táki Athanássios Cordás. 2022. Craving for Carbs: Food Craving and Disordered Eating in Low-Carb Dieters and Its Association with Intermittent Fasting. Eating and Weight Disorders: EWD 27 (8): 3109–17.

- Rideout CA, et al. High Cognitive Dietary Restraint is Associated with Increased Cortisol Excretion in Postmenopausal Women. The Journals of Gerontology. June 2006; 61 (6):628-633

- Kiefer, Amy, Jue Lin, Elizabeth Blackburn, and Elissa Epel. 2008. Dietary Restraint and Telomere Length in Pre- and Postmenopausal Women. Psychosomatic Medicine 70 (8): 845–49.

- Li DCW, Rudloff S, Langer HT, Norman K, Herpich C. Age-Associated Differences in Recovery from Exercise-Induced Muscle Damage. Cells. 2024 Jan 30;13(3).

- Alfaro-Magallanes VM, Benito PJ, Rael B, Barba-Moreno L, Romero-Parra N, Cupeiro R, et al. Menopause Delays the Typical Recovery of Pre-Exercise Hepcidin Levels after High-Intensity Interval Running Exercise in Endurance-Trained Women. Nutrients. 2020 Dec 17;12(12).

- Harvey PJ, O’Donnell E, Picton P, Morris BL, Notarius CF, Floras JS. After-exercise heart rate variability is attenuated in postmenopausal women and unaffected by estrogen therapy. Menopause. 2016 Apr;23(4):390–5.

- Espeland, M. A., M. L. Stefanick, D. Kritz-Silverstein, S. E. Fineberg, M. A. Waclawiw, M. K. James, and G. A. Greendale. 1997. Effect of Postmenopausal Hormone Therapy on Body Weight and Waist and Hip Girths. Postmenopausal Estrogen-Progestin Interventions Study Investigators. The Journal of Clinical Endocrinology and Metabolism 82 (5): 1549–56.

- Institute of Medicine (US) Committee on Military Nutrition Research. Pharmacology of Caffeine. National Academies Press (US); 2001.

- Nehlig A. Interindividual Differences in Caffeine Metabolism and Factors Driving Caffeine Consumption. Pharmacol Rev. 2018 Apr;70(2):384–411.

- Shou J, Chen PJ, Xiao WH. Mechanism of increased risk of insulin resistance in aging skeletal muscle. Diabetol Metab Syndr. 2020 Feb 11;12:14.

- Nygaard H, Tomten SE, Høstmark AT. Slow postmeal walking reduces postprandial glycemia in middle-aged women. Appl Physiol Nutr Metab. 2009 Dec;34(6):1087–92.

- Bellini A, Nicolò A, Bazzucchi I, Sacchetti M. The Effects of Postprandial Walking on the Glucose Response after Meals with Different Characteristics. Nutrients. 2022 Mar 4;14(5).

- Dupuy O, Douzi W, Theurot D, Bosquet L, Dugué B. An Evidence-Based Approach for Choosing Post-exercise Recovery Techniques to Reduce Markers of Muscle Damage, Soreness, Fatigue, and Inflammation: A Systematic Review With Meta-Analysis. Front Physiol. 2018 Apr 26;9:403.

- Doma K, Ramachandran AK, Boullosa D, Connor J. The Paradoxical Effect of Creatine Monohydrate on Muscle Damage Markers: A Systematic Review and Meta-Analysis. Sports Med. 2022 Jul;52(7):1623–45.

- Gordji-Nejad A, Matusch A, Kleedörfer S, Jayeshkumar Patel H, Drzezga A, Elmenhorst D, et al. Single dose creatine improves cognitive performance and induces changes in cerebral high energy phosphates during sleep deprivation. Sci Rep. 2024 Feb 28;14(1):4937.

- Smith-Ryan AE, Cabre HE, Eckerson JM, Candow DG. Creatine Supplementation in Women’s Health: A Lifespan Perspective. Nutrients. 2021 Mar 8;13(3).

- Rae, Caroline, Alison L. Digney, Sally R. McEwan, and Timothy C. Bates. 2003. Oral Creatine Monohydrate Supplementation Improves Brain Performance: A Double-Blind, Placebo-Controlled, Cross-over Trial. Proceedings. Biological Sciences / The Royal Society 270 (1529): 2147–50.

If you’re a coach, or you want to be…

You can help people build sustainable nutrition and lifestyle habits that will significantly improve their physical and mental health—while you make a great living doing what you love. We’ll show you how.

If you’d like to learn more, consider the PN Level 1 Nutrition Coaching Certification. (You can enroll now at a big discount.)