One of the judges, Jasina Morris, CIC, senior vice president at Alliant Insurance Services and a board member of the Dallas–Fort Worth Chapter of the National African American Insurance Association (NAAIA DFW), explains what impressed her the most.

“All the nominees were incredibly strong. I found myself especially looking for individuals who demonstrated a combination of leadership and accomplishments within their organizations, insurance community engagement, and forward thinking,” she says. “The winners stood out because they went beyond expectations; they showed initiative, a strong sense of purpose, and a clear commitment to shaping the future of the insurance industry.”

Morris also highlighted the challenges facing the Rising Stars to stand out in the current climate. She adds, “The industry is in the midst of significant transformation, with increasing client expectations and rapid technological change. For early-career professionals, navigating this complexity while still building credibility, networks, and technical expertise can be daunting.”

The importance of young professionals is particularly important as, according to Yupro Placement, the insurance workforce is markedly older than the general US workforce, with a median age of 45, and 25 percent of employees over 55 years old.

They refer to this aging demographic as “a ticking clock, signaling a forthcoming exodus of institutional knowledge and experience.”

An analysis of all the winners shows there are clear patterns in attributes and behaviors that have set the Rising Stars apart. These trends offer valuable insights into what makes the next wave of insurance leaders truly exceptional.

1. Mentorship and talent development: investing in others early

One of the most common – and powerful – traits shared among top young professionals is a proactive commitment to mentorship. They exemplify this with structured mentorship initiatives, designed to support junior team members both within and beyond their immediate teams.

This deliberate investment in others is a strategic tool. By helping new hires navigate complex insurance issues, the Rising Stars are accelerating team performance, reducing onboarding friction, and building future-ready teams. Such efforts foster a collaborative, high-trust environment – a competitive edge in a knowledge-driven sector.

This mentorship mindset signals maturity beyond years. It also reveals a growing emphasis among younger professionals on ecosystem success rather than just individual advancement.

2. Technology-driven innovation: blending domain expertise with digital fluency

The insurance industry’s digital transformation isn’t just about tools – it’s about people who can lead that change. Young professionals like IBA’s Rising Stars are at the forefront, identifying inefficiencies and spearheading technological solutions that directly impact client outcomes.

Their revamping of their firm’s risk assessment and reporting tools illustrates a key trend: the blend of domain expertise with digital fluency. By collaborating with IT and analytics teams, they are creating streamlined, user-friendly platforms that enhance the speed and accuracy of data collection and client reporting.

3. Change leadership and cross-functional collaboration

Young insurance leaders aren’t waiting for permission to lead change – they’re building the platforms for it. Their involvement reflects a broader trend where high-potential employees are being entrusted with internal innovation roles, effectively serving as cross-functional change agents.

This appetite for continuous improvement signals a mindset that is both entrepreneurial and systemic. Rising professionals are not only suggesting new ideas – they are institutionally embedding them, ensuring innovation becomes repeatable and measurable.

Many of the Rising Stars are scaling their impact by codifying their methods, creating training programs for junior staff and establishing documentation of best practices for their teams. These actions reflect a mindset focused on sustainability and replication of success.

Collaboration is central to this trend. Whether it’s between analytics, underwriting, or client services, the best young professionals are not siloed but fluent in cross-disciplinary dialogue.

4. Advocacy for diversity, equity, and inclusion (DEI)

Another defining trait of today’s top young professionals is their advocacy and leadership in organizing workshops and dialogues around the role of diverse perspectives in risk management, highlighting the active role of IBA’s Rising Stars in shaping workplace culture.

These efforts go beyond compliance or public image. They’re rooted in a recognition that diverse teams make better decisions, particularly in an industry that relies on nuanced judgment and global insight. They understand that a truly inclusive environment not only attracts the best talent but also yields more resilient and innovative outcomes.

In fact, DEI leadership is increasingly becoming a differentiator for top talent. Organizations are taking notice, rewarding those who champion equity as a strategic advantage.

5. Purpose-driven leadership: aligning values and business impact

Underlying all these traits is a deeper orientation toward purpose as the top young professionals seek meaning. Whether it’s improving client service through better tools, elevating peers through mentorship, or championing inclusion, their work is consistently tied to broader business and social impact.

This alignment between personal values and business goals creates a powerful sense of mission. It’s also becoming a core component of leadership readiness in the insurance industry.

As organizations compete for top talent, those that can offer this kind of purpose-aligned growth path will increasingly attract the best of the next generation.

Conclusion: leadership reimagined

-

Today’s best young insurance professionals are not waiting to be told what to do.

-

They take initiative, lead through collaboration, and mentor with intention.

-

They are agile, culturally aware, digitally fluent, and relentlessly people-focused.

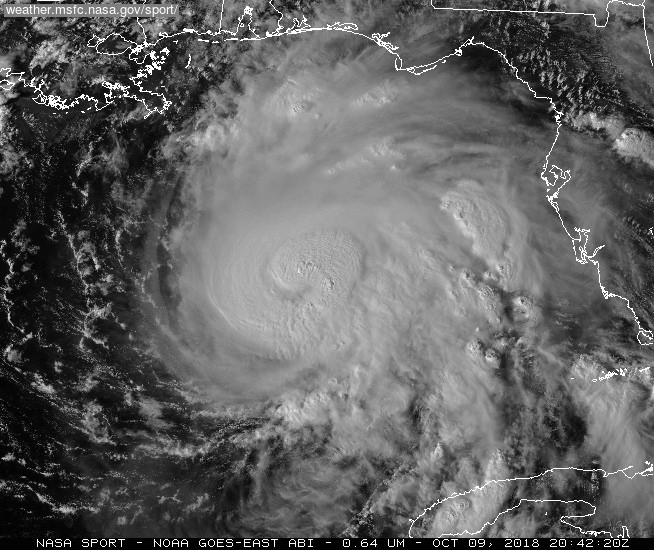

When Stephanie Sherman, 32, began her role as a producer, she was quite literally thrown into the eye of the storm, having to immediately navigate 2022’s Hurricane Ian, one of the costliest disasters in American history.

“Nobody in the office had any internet service,” explains the now vice president of sales. “I would have to drive miles away from my house, waiting for a little bit of cell service in order to respond to client’s emails.” That experience has enabled her to alert potential clients of Florida’s changing geographical landscape, and why those who may not have needed insurance previously will benefit from Harbour Risk Management (HRM)’s services. This includes clients who had not been living in a recognized flood zone but are now at risk.

Her book has grown to $300,000 in revenue, mainly through working with high-net personal lines clients. During sales pitches, Sherman does not shy away from the fact that HRM’s services are generally more expensive than competitors. Explaining the value she can deliver to clients in a clear and honest manner builds a relationship that may not lead to immediate results but creates trust for the future.

“Of course, I’ve lost clients over price, but they always thank me for explaining,” she says. “And after a year or two, sometimes they’ve come back to me because they remember the conversations that we had and the attention that I gave them.”

“I set expectations and talk to clients straightforward, telling them that I’m not able to get to this today, but I will have an answer tomorrow”

Stephanie ShermanHarbour Insurance

One key trait that has aided Sherman’s rise is her communication skills. This includes acknowledging clients even if she is not immediately available.

“If I’m on my way to pick up my son and someone is calling me, even if I’m not able to answer the call, I’ll send them a text acknowledging that they reached out to me. People want to feel and see that attentiveness.”

By listening to her clients’ needs and providing real-life examples from a region she has inhabited her whole life, Sherman emphasizes a sales tactic that goes beyond numbers.

She says, “I like taking the time to educate clients, talking them through every coverage and what it means, explaining to them real-life scenarios. People can look at numbers all day but whenever you give them actual scenarios, it makes them sit and think, ‘Wow, she’s right.’” Her constant desire to keep growing has led her to achieve the top producer status at her agency repeatedly.

“My goal is to keep that momentum going. I strongly believe that you get what you put into it,” she says. “I’m not going to see a million-dollar book if I’m working part time. I know that the time to hustle is now.”

Social media is a key component for young producers like Sherman because it allows her to access a wider client base. She increases her visibility by partnering with real estate agents, financial advisors, and mortgage lenders.

“Technology is definitely one of the main things that are helping young agents put themselves out there. The younger generation has more of an advantage with social media and networking groups.”

With a primary role helping to lead the ProEx (management liability) department in the Los Angeles and Central California region, Chris Rhi supports producers and their clients, focusing on management liability and financial lines.

As a coverage and placement specialist, Rhi, 35, cultivates strong relationships with carrier and wholesale broker partners, continuously pressure-testing them to secure optimal pricing and coverage.

And for the director of private and non-profit management liability, while adopting increasing amounts of technology is integral, there is a more important emphasis on building strong human relationships.

“As things get automized especially with the advent of AI upon us, it’s just even more important to keep that human touch,” he says. “I love having face time with underwriters and the partners that we work with, and I think clients are also a very important part of that discussion. Creating those win-win situations is my goal every day.”

“Insurance is one of those products where you really have to take a step back and look at things from a global standpoint”

Chris RhiHUB International

Rhi outlines the challenges faced by the insurance industry with fluctuations in premiums forcing firms to pivot at short notice.

“There’s a lot of sensitivity from insurance companies these days; our soft market in the financial line space has gone quite longer than expected and their books are drying up. They’re losing accounts, and at the same time, the premiums are going down,” he explains. “Looking out for each other is crucial and creating that empathy is how I have navigated everything.”

Rhi also serves as the product co-leader for private and non-profit management liability nationwide due to being passionate about educating and mentoring younger colleagues through training webinars with carrier partners. One of his key contributions has been creating The ProEx Library, a centralized collection of essential financial lines resources, including policy forms, endorsements, applications, and coverage comparisons. He uses the term “fulfilling” in response to the project’s success.

He says, “Our country’s diversity is what makes it so beautiful. I deeply believe in recognizing and honoring our own cultures and communities while embracing and supporting others.”

To this end, he represented HUB at Chubb’s sponsored table for the University of Southern California’s Latin American Alumni Association gala as an alumnus. Despite not being Latin American, he was keen to take the opportunity to celebrate this community.

Additionally, Rhi has proudly represented HUB for three years at the LiNK (Liberty in North Korea) gala through a client partnership – which is close to home as his grandfather escaped the North Korean regime prior to the Korean War – and is also actively involved in AAPI organizations.

As vice president of broker relations, Sam Hickey has overseen RRS’s expansion into 16 different states, an accomplishment he sees as an example of both his own career growth, along with that of the company.

While this growth has created hurdles for the executive, who is noted for his dedication, strategic thinking, and ability to lead by example, it underlines the importance of staying nimble and developing long-lasting relationships with brokers.

“Building the trust and getting the buy-in from the broker community outside of our home turf has been probably the most challenging thing. But you can’t just flip a switch,” says Hickey, based in RRS’s East Coast branch. “It’s fun to get out and meet people who are experts in their territories that I have never dealt with my career.”

“I try to meet with each broker individually at least quarterly to discuss what challenges they’re facing with other markets, and where we can step in and help”

Sam HickeyRoosevelt Road Specialty

Part of his role includes educating brokers on the value-added claims and risk management services available to all insureds, keeping them up to date with RRS’s offerings to better serve their clients.

The 30-year-old executive explains that during his regular meetings with brokers, he holds himself and those he works with accountable. This includes a high degree of transparency, ensuring that both parties always remain on the same page.

He explains, “Ultimately, having open lines of communication and transparency leads to stronger relationships. You’re not going to win every deal together, but every transaction ends up being a learning experience.”

Beyond his core duties, Hickey actively develops innovative solutions tailored to the complex needs of clients, such as facilitating Roosevelt Road’s Tradesman Program. This initiative provides clients with 24/7 loss control support, monthly site visits, and access to Field Flo, a complimentary construction management software designed to enhance operational efficiency.

As an account executive at Alliant Construction Services Group, Emmeline Kuo handles the day-to-day insurance needs for clients, including maintaining schedules, issuing certificates, and reviewing contracts and policies.

She also manages bigger-picture objectives like identifying loss trends, discussing changes in the market and operations and their impact on an insured. She also coordinates the Alliant team, making sure that representatives from risk control, claims, surety, and the insurance servicing team work together toward collective success.

Maintaining a healthy work-life balance, including an interest in travel, has been deeply influential in 36-year-old Kuo’s success.

“From a broker perspective, a lot of what we do gets easier with more experience. The more you do it, you develop efficiencies within what you’re doing”

Emmeline KuoAlliant Insurance Services

“Every time I go away on a big trip, I get perspective on my own life. I have a tendency to get caught up in the details and travel, for me, is just a reminder of the bigger picture,” she says.

With AI increasingly ever-present, Kuo thinks the fast-moving technology is an important tool, but like other Rising Stars, believes that the value of human interactions cannot be overstated. She explains, “Everyone loves to talk about AI and tech, and my opinion is that as much as things change, things also really stay the same. From a broker perspective, my value comes with my relationship with clients and that can’t be replaced by AI – at least not yet.”

Benefitting from a long-time mentor who has spent four decades in the industry, Kuo passes on this invaluable insight and knowledge to other young women in her field.

“I came in at Alliant still very much in a more of a mentee role, and then in these last years, that has started to flip and I’ve realized I’m now the more senior person in a lot of aspects,” she says.

“I try to be supportive and encouraging. We do get stressed out, and I try to model appropriate behavior for what that looks like – not lashing out and making sure that you’re still constructive even when you’re frustrated.”

While soft skills can be overlooked, Kuo argues that these are just as important as the more technical attributes.

“Listening is such a critical skill,” she adds. This ability to communicate clearly and dedicate her time is illustrated by how she often contributes to insurance coverage conversations to proactively address and resolve problems.

In many instances, the contractor insureds are pressured by another party to provide certificates with inaccurate or incorrect wording. They can be refused entrance to a job site and threatened with delays in the project. Kuo participates in meetings to explain why those requests cannot be completed; this allows insureds to move forward with their projects and avoid any delays.

IBA also gathered industry experts’ views on what moves the needle as a young professional in today’s insurance industry.

Mindy Pranculeviciute, senior recruiter at Talentfoot Executive Search and Staffing, believes the highest performers combine technical fluency with commercial intuition.

“They understand underwriting and claims inside and out, but they are also comfortable using AI tools to streamline workflows, optimize pricing, and detect fraud. They do not just react to market trends; they anticipate them,” she says.

Pranculeviciute also perceives these future leaders as curious learners and bold collaborators.

“Whether it is improving straight-through processing with automation or co-creating innovative products for emerging risks like cyber or climate, they are solving problems that legacy thinking cannot. What sets them apart is this: they think like actuaries, operate like technologists, and lead like entrepreneurs,” she explains.

Senior vice president and managing director at The Jacobson Group, Judy Busby, views the best young professionals as having a combination of intellect, empathy, plus technological and emotional intelligence.

“These traits, along with a zest for learning – whether it’s through certification programs or continuing education – will enable individuals to showcase their strengths while staying relevant throughout their careers,” she says.

Considering the use of AI and embracing technology common among 2025’s Rising Stars, Busby also feels this will pay dividends throughout their working lives.

She adds, “By building your knowledge base and remaining future-focused, they will have the transferable skills and business perspective to be successful as their career evolves.”