Jump to winners | Jump to methodology

Beyond the buzz: turning promise into results

The AI explosion has ramped up the pressure on the world’s top insurtechs to deliver and push the boundaries even further.

The companies meeting these exacting demands are recognized by Insurance Business as the 5-Star Technology and Software Providers 2025 and were determined after the global broking network nominated and ranked their standout performers.

Their solutions drive business value, from faster claims processing to smarter underwriting, enable digital distribution models, and provide insurer-specific understanding, while introducing AI where it is most effective.

“Although AI is essentially new to insurance, boards and C-suites have high expectations to take the lead,” says Alan Demers, president of InsurTech Consulting. “Those expectations are buoyed with caution for the possibilities of what could go wrong. It’s a true mix of fear and exciting opportunities.”

Proving the point, more than 60 percent of all insurtech deals in early 2025 involved AI, reflecting its rapid rise in underwriting, claims, customer service, and risk modelling, according to the Q1 2025 Global InsurTech Report.

Other key data points reinforce the momentum:

-

Global insurtech funding surged 90.2 percent quarter over quarter, reaching US$1.31 billion, the highest level since late 2022

-

Three mega-rounds over US$100 million were recorded for P&C-focused firms: Quantexa (US$175 million), Openly (US$123 million), and Instabase (US$100 million)

-

AI-led insurtechs raised a combined US$710.86 million across 60 deals, with an average size of nearly US$ 14 million

For many insurers, the hype has outpaced practical understanding, but that’s changing. As George Shelton, head of venturing at Alchemy Crew Ventures, explains, “AI, and especially generative AI, has raised the bar in terms of what we expect from insurance software.”

He describes the sector as deeply complex and data-dependent, having historically lagged behind other industries in innovation. That slow pace now leaves room to move.

“There is plenty of low-hanging fruit,” Shelton says. “But we’re a lot less forgiving of AI than we are of our human counterparts, especially given the wide variety of so-called solutions flooding the market.”

And he also explains that the top insurtechs don’t lose sight of the end goal. “Insurers are grappling with a perfect storm of significant challenges, many of which are increasingly complex and potentially very disruptive,” Shelton says. “The goal is to help insurers become more agile, resilient, and customer-centric.”

Separating value from marketing spin

AI has become the defining talking point of the tech space, but insurance leaders are wary of inflated promises and one-size-fits-all platforms.

“Nearly every solution provider has ‘AI’ in their URL, somewhere on their websites and marketing collateral,” says Demers. “This makes it difficult to assess and distinguish among players, never mind attributing real cost-benefit analysis.”

He warns that while generative and agentic AI are showing potential, many carriers are still experimenting and struggling to find solutions tailored to their business needs.

Demers points to specific progress in “co-pilot or agent use cases,” such as claims reserving. Shelton reinforces the point: “AI is a game-changer, but only when implemented thoughtfully.”

The value lies not in the tech itself but in how it’s trained and deployed. “The real value comes from tailored, insurance-specific AI models that are rigorously tested for fairness and compliance, and that are fully explainable and understood by those using them,” Shelton says.

Real progress is being made with measurable improvements in:

“Expectations have soared with the emergence of generative AI,” Demers adds. “The bar is raised high for new innovation, breakthroughs on efficiency and cost advantages, as well as better risk selection and pricing.”

What sets the top insurtech companies apart

The global market is crowded with vendors offering transformation. However, separating value from industry noise requires operational fluency and a deep understanding of how insurance companies operate.

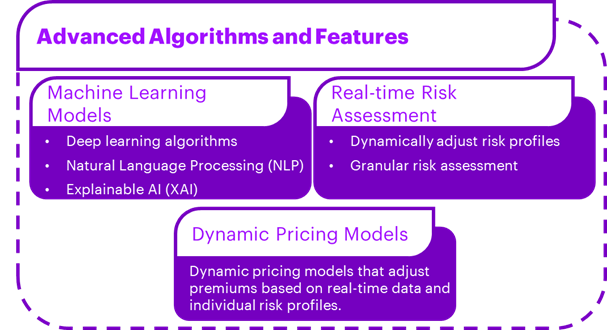

Four key patterns emerged across the top insurtech companies based on brokers’ insight:

-

AI expectations are rising fast. Generative AI has become a strategic issue. But off-the-shelf models are losing ground to purpose-built, insurance-specific solutions.

-

Implementation is now a credibility test. If a system can’t integrate smoothly with legacy infrastructure or deliver value on day one, it doesn’t make it through procurement.

-

Customization is expected. Off-the-shelf software is being replaced by flexible platforms that adapt to niche product models and market-specific strategies.

-

Outcomes are everything. Buyers are watching for real impact, reduced loss ratios, faster processing, and better CX. Features alone no longer close the deal.

For Demers, who previously led major claims operations, staying power, domain expertise, and measurable results remain the hallmarks of top-tier providers.

“Top providers often bring attendant scale, reliability, and are mature enough to bring insurance acumen as an added dimension,” he says. “The best tends to provide rich benchmarking information as carriers constantly compare performance given the highly competitive market.”

While established players dominate through stability and scale, newer entrants are also gaining ground. Demers adds, “New entrants often gain traction by offering the latest in technology and innovative influences to set themselves apart.”

Innovation leader Shelton echoes this sentiment. “Great partners make working with them a no-brainer. As efficiency and profitability pressures mount for insurers, the industry is ripe with opportunity. However, prospective partners must be able to deliver measurable value, on insurer’s terms, from day one, in a flexible, responsive, and collaborative way.”

Tackling legacy drag and risk that won’t wait

The insurance industry is under pressure from aging tech stacks, new risk types, evolving customer expectations, and an increasingly complex regulatory environment.

Technology partners must go well beyond implementation and are expected to bring solutions to systemic challenges while minimizing disruptions to core operations.

Demers identifies three critical areas where the right tech makes a difference:

-

profitability pressures in stressed lines like homeowners and commercial auto

-

fragmented systems and expensive tech stacks that hinder efficiency

-

the push to adopt AI responsibly, especially around data quality, privacy, and business relevance

Shelton offers a complementary list of challenges that insurers expect their vendors to address:

-

growing complexity of risk, from cyber to climate

-

rising regulatory and data privacy requirements that demand more than box-checking

-

operational inefficiencies due to layered legacy infrastructure

-

consumers demanding personalization and digital ease, even as they cut back on spending

-

internal pressure to launch new products and distribution models without expanding overhead

“From a strategic point of view, tech and software providers should recognize that their services can extend beyond solving a technological problem toward helping their clients to actively innovate, improve, and develop new products and services, based on smart feedback,” Shelton says.

Measuring what matters:

the ROI converstion

In a space crowded with demos and marketing noise, insurance leaders don’t want to buy promises. Efficiency gains are still table stakes, but they’re no longer the whole story, Demers remarks.

“At present, revenue growth is probably No. 1, as P&C has restored profitability and underwriting appetites are growing quickly,” he says. “Loss ratios would be a close second. Decision-makers want to see benefits in all, including customer satisfaction.”

Shelton agrees that evaluating ROI in insurance tech is crucial and must be a blend of quantitative and qualitative data.

“The magic numbers of loss ratio and expense ratio will always be top of a conventional insurer’s mind,” Shelton says.

Data analysis of what the world’s brokers want

Tools that work quickly, integrate seamlessly, and deliver measurable value under current business conditions are the top requirements.

A comparison of IB’s global ratings from 2023 to 2025 also uncovers a series of trends:

Key patterns and insights

-

2024 dip: All criteria experienced a dip in 2024, suggesting either higher expectations or market challenges.

-

2025 recovery: All criteria rebounded in 2025, with some reaching their highest levels, indicating improvements in technology offerings or better alignment with broker needs.

-

Ease of use dominance: This remains the most important factor, highlighting the necessity for intuitive, user-friendly technology.

-

Customization volatility: The sharp drop and recovery suggest that brokers’ needs for tailored solutions may fluctuate with market or regulatory changes.

-

Consistency in value and support: Value for money and customer support are stable, underscoring their ongoing importance.

IB’s historical data supports what Shelton and Demers flagged: buyers want platforms that align with their environment, not the other way around.

“Implementation is not just a matter of speed,” Shelton says. “It’s a marker of whether a provider understands how insurance businesses operate.”

Customization saw the biggest year-over-year gain, rising 0.22 percent illustrating that off-the-shelf solutions are losing ground to providers who help insurers tailor everything from workflows to product design. Ease of use, already near the ceiling, remains the single highest-rated factor. That reinforces a hard truth that if frontline teams can’t use a platform easily, they won’t.

Inside IB’s Global 5-Star Technology and Software Providers 2025

Purpose-built innovation and proven results

Vertafore, one of the industry’s most established insurtech firms, takes a practical approach to innovation. Its innovation strategy prioritizes foundational problem-solving over stacking on unnecessary features. That ethos drives breakthroughs in daily workflows, boosts relationships, and fuels scalable growth for customers.

Vertafore serves agencies, wholesalers, MGAs, and carriers of all sizes. That reach gives the company a front-row seat to shifting needs across distribution, underwriting, and compliance.

That insight pairs with an open feedback loop with customers and the NetVU user group, allowing the product team to turn top requests into reality.

Time saved is value delivered

One flagship initiative, Project Impact, cuts the time agencies spend on repetitive, high-volume tasks. Vertafore staff shadowed more than 100 servicers across AMS360, Sagitta, and WorkSmart to identify pain points in real workflows.

The result was dozens of enhancements that have already saved nearly an hour per day for many users. “Innovation is essential for our industry to thrive, but to make a lasting impact, it has to be about more than simply chasing what’s new,” chief project officer James Thom explains.

“Our innovation process starts with a focus on what’s going to propel our customers’ long-term success. That ensures innovations deliver measurable value, such as quantifiable time savings, improved client retention, faster processes, and business growth.”

“Our goal is to simplify the entire insurance life cycle so customers can focus on what matters most to their business”

James ThomVertafore

Launched in December 2024, AgencyOne is Vertafore’s integrated platform built on AMS360 and Sagitta, which brings together everything agencies need to run and grow their business.

Designed to simplify how agencies operate, AgencyOne includes:

-

sales automation that optimizes day-to-day activity

-

real-time, competitive quoting and binding

-

modern digital experiences for today’s insurance clients

-

streamlined agency management workflows

-

Data and analytics for smarter decision-making

Faster navigation and improved search functions alone can free up two weeks per employee per year. “AgencyOne gives a 360-degree view of client information with personalized dashboards and global navigation, making an agent’s work easier every day,” Thom says. “That kind of unified experience translates into real time savings and lets agents spend more time on business growth and client engagement.”

Open architecture, long-term support

Underpinning Vertafore’s technology is an open-architecture strategy built on APIs and microservices, as well as its Orange Partner program.

This ecosystem enables agencies, MGAs, and carrier partners to plug in best-in-class tools, extend workflows, and maintain a seamless experience across its suite and complementary technologies.

In 2020, Vertafore found a permanent home through its acquisition by Roper Technologies. That long-term backing allows Vertafore to reinvest nearly a quarter of its revenue in product development, UX/UI enhancements, and continuous platform modernization.

Recent design updates emphasize:

“Our goal is to simplify the entire insurance lifecycle so customers can focus on what matters most to their unique business needs,” he adds. “We’re delivering tools that work today and evolve to meet tomorrow’s challenges.”

Vertafore will extend the Project Impact approach to new workflows and surface AI-driven recommendations across its platform. Its focus remains on uniting the distribution chain, empowering agencies, MGAs, and carriers with customer-centric solutions that drive real business outcomes.

Redefining automation with impact, not overhead

In a market where speed, accuracy, and experience set the minimum bar for competition, automation has become more than a cost-cutting tool. TCG’s flagship platform, DocProStar, combines AI, legacy integration, and no-code process design to deliver speed without adding technical complexity.

“Initially, clients were primarily focused on cost savings by automating repetitive administrative tasks such as data extraction and email triage,” says managing director Frank Volckmar. “These early-stage implementations delivered a strong return on investment, often achieving payback in under 12 months.”

Development now sees clients using automation to enhance both employee and customer experiences. “While cost reduction remains important, the focus has expanded to include broader strategic goals; namely, improving employee and customer experiences,” Volckmar says.

DocProStar stands out for its no-code, BPMN-based interface, which enables claims managers, underwriters, and operations staff to map, test, and refine workflows without writing a single line of code.

“This inclusive approach accelerates automation rollouts while ensuring the people closest to the business challenges can actively contribute to process innovation,” Volckmar says. “The result is faster time-to-value, broader alignment across teams, and more resilient, business-driven automation initiatives.”

Connecting legacy systems without rework

TCG designed DocProStar to act as an orchestration layer, connecting legacy platforms to modern AI tools and third-party systems. For many insurers, this ability to bridge old and new is crucial.

For example, one client now uses DocProStar to ingest claims documents, extract key data, classify inputs, and automate decisions using AI, all while syncing with its core insurance platform for validation.

“In some implementations, clients also ‘scrape’ data from legacy platforms and merge it with AI outputs within DocProStar, turning fragmented tasks into measurable, end-to-end processes,” Volckmar adds.

“As insurers continue their digital transformation, we see OCTO playing a pivotal role in unlocking new efficiencies and accelerating the practical application of AI”

Frank VolckmarTCG Process

What many still miss about AI

Despite strong adoption, Volckmar states that many insurers still underestimate what it takes to get automation right:

-

lack of standardization across teams or departments

-

distrust in AI outputs due to fears of hallucination or inaccuracy

-

weak evaluation frameworks that fail to weigh privacy, security, and performance

“With so many services in the market, it’s vitally important to work with specialized consultants who can align technology with actual business needs.”

TCG is focused on expanding AI across high-volume use cases, such as claims and underwriting, through OCTO, a new orchestration module embedded in DocProStar.

“Use cases already emerging include the integration of AI into legacy applications, validation of incoming data against business rules to enhance data integrity, and AI-powered support for knowledge workers embedded directly in their workflows,” Volckmar says.

Faster total loss valuations with market-driven accuracy

In Australia’s motor insurance market, total loss valuation has long been a sticking point. Clunky workflows, inconsistent data, and drawn-out disputes have frustrated assessors and claimants alike.

AutoGrab has stepped into that gap with its Pre-Accident Valuation (PAV) platform, which combines real-time market data with human-guided decision-making to streamline the process and improve trust.

“It was fraught with errors,” recalls Denis Flora, national customer manager for insurance. “If they weren’t selecting the right vehicle, it meant they weren’t producing the right value on a total loss.”

Built for speed and evidence

During the height of the pandemic, as car prices surged and supply chains crumbled, AutoGrab launched its solution to reduce manual steps and improve consistency.

By automating the grunt work, matching vehicle identification and description, and drawing on a deep catalogue of advertised listings, the platform reduces the average time per case to seven to 10 minutes, a 60 percent time saving with improved accuracy.

“The pain was acute during COVID,” Flora says.

Users are guided through an easy-to-navigate interface and receive a transparent, customer-ready PDF report.

“Our anecdotal feedback is that nine out of 10 customers agree with the outcome of the report because they’ve got the evidence there,” Flora adds.

“We offer the perfect blend of technology assistance within the highly customer-focused and personable process of the insurance motor claims value chain”

Denis FloraAutoGrab

Settlement value complaints remain among the most frequent insurance disputes in Australia, according to AFCA. To support transparency, AutoGrab’s reports include comparable listings, price history, and state-specific market dynamics.

“If a customer is dissatisfied with a total loss claim’s value, the insurer can provide the AutoGrab PAV PDF report to show how the value was calculated,” he explains.

Real-time data that moves with the market

AutoGrab’s proprietary catalogue covers 99.3 percent of vehicles under 4.5 tons, dating back to 1983. It’s updated regularly through its global partnerships.

The coverage is expanding faster than that of other tools on the market, thanks to those partnerships and exclusive access to new models, making it the quickest on the market to grow.

Advertisements are matched to the catalogue and monitored throughout the sales cycle, including pricing movements, days to sell, and supply and demand dynamics. This data is analyzed to produce an accurate market-reflective price, supported by actual listings and sales data.

Human insight still matters

While the platform uses machine learning to suggest an estimated retail value, human expertise remains central to the process, especially in insurance.

“We present all of the data, insights, and listings to the customer, and they make the call on which vehicles to use in the valuation,” Flora explains. “Every vehicle is unique. It may have different accessories, modifications, or pre-existing damage. That’s where the human interaction comes in.”

What’s changed is the quality of information behind those decisions. In addition to presenting comparable listings, AutoGrab includes state-based supply and demand stats, odometer averages, and national pricing trends. Flora calls it a holistic picture.

“That price may be different on the last day of the month compared to the first day of the month because listings may have changed,” he says. “We present all of that to our users to make that call.”

From motor claims to full cycle expansion

Since its launch in 2020, AutoGrab now serves insurers and underwriting partners in Australia, New Zealand, the UK, and Asia. While its foundation lies in insurance, the company is well established in other verticals, including dealership platforms, fleet management, finance, and government.

“Holistically, the automotive industry is our oyster,” Flora says. “But we see really good benefits for insurers, not only to drive their claims performance and policy portfolio performance better, but to improve their customer engagement and transparency, which drives loyalty and retention.”

AutoGrab is now expanding deeper into the claims lifecycle, from lodgment and repair assessment to underwriting and quote generation.

Internationally, it already provides fully automated valuations for insurers. In Australia, the hybrid model, combining machine intelligence with human discretion, remains the optimal fit. But the technology is designed to scale.

Insurtech is no longer a sandbox for theories. AI may be in the spotlight, but insurers and brokers are focused on what works. They want tools that deliver results. Tech that cuts the noise, fixes the headaches, and helps teams perform more efficiently.

IB’s 5-Star Technology and Software Providers 2025 have earned their reputation by remaining focused on execution. They’re not selling software; they’re solving problems for brokers and insurers in demanding, complex environments globally.

- AgencyBloc

- Alert Labs

- Applied Systems

- Bentek

- Curium

- Decerto

- EcoClaim

- Folio.insure

- Foxquilt

- InsuredHQ

- Life Design Analysis

- ProNavigator

- Quandri

- QuickFacts

- Quotey.io

- RedBook New Zealand

- SambaSafety

- TCG Process

- Trufla Technology