Confused about the 4% retirement rule? Discover why experts like Bengen keep changing the safe withdrawal rate—and why 3.5% may be safer in India.

Retirement planning often boils down to one practical worry: “How much can I safely withdraw from my nest egg each year so the money lasts as long as I do?”

The answer people hunt for is a single number: the Safe Withdrawal Rate (SWR). The most famous of them is the 4% Rule, born from William Bengen’s research in the 1990s. But over three decades Bengen has refined his view several times — and those changes matter. This article explains why Bengen changed his recommendations, the assumptions behind his numbers, why the U.S. findings don’t map neatly to India, and why — for most Indians — 3%–3.5% (and as low as realistically possible) is the safer zone.

Safe Withdrawal Rate India: Is 3.5% Better Than the 4% Rule?

What exactly is a Safe Withdrawal Rate (SWR)? — Simple language

SWR answers a practical question: from a retirement corpus, how much can you take out in the first year, then increase that amount every year to match inflation, and still expect the money to last (for a set horizon like 30 years)?

Example (simple): retire with Rs.1 crore.

- A 4% SWR means withdraw Rs.4,00,000 in year one. In year two, increase the rupee amount by the inflation rate (to keep purchasing power). Repeat each year. The SWR is “safe” if, historically, that plan survived for the retirement horizon being tested.

Two things to remember:

- SWR is an estimate based on historical data and specific portfolio assumptions.

- It is not a guarantee — it depends on future returns, inflation, and how long you live.

Refer my earlier post on SWP and how it is actually misguided in this financial world “Systematic Withdrawal Plan SWP – Dangerous concept of Mutual Funds“

William Bengen — where the 4% came from (and the data behind it)

In 1994 William Bengen analysed long-run U.S. historical returns (stocks and bonds back to 1926). He tested many starting years and withdrawal rates for a 30-year retirement horizon. His headline result: 4% (first-year withdrawal, then inflation adjustments) would have survived almost all historical 30-year retirements in the U.S.

Important details that are often missed:

- Portfolio assumed: Bengen’s tests assumed a balanced portfolio — roughly 50–75% in U.S. equities (mainly large-cap stocks) and 25–50% in intermediate-term government bonds. The 4% result depends on staying invested in this mix and not panic-selling after crashes.

- Worst starting year: one of the toughest historical start years was 1966, which produced a maximum sustainable rate around 4.15% in Bengen’s backtests. He rounded down to 4% as a conservative, easy-to-remember rule.

- Not a law: Bengen’s result was empirical — “it survived in historical data” — not a universal mathematical truth.

How and why Bengen revised his recommendations over time

Bengen did not proclaim “4% forever” and stop. As markets changed and he ran new tests, he updated his findings. Summarised:

| Period / Research Phase | Portfolio Assumption | Bengen’s suggested SWR (approx) | Why he changed |

| 1994 (original) | 50–75% US equities + bonds | 4.0% | Historical worst-case (e.g., retirement starting 1966) survivals led to 4% as conservative round number. |

| Late 1990s–2000s | Add U.S. small-cap exposure | 4.5%–4.7% | Small caps historically improved long-term returns and survival rates in backtests. |

| 2010s | Same assets, but much lower bond yields & higher equity valuations | ~3.5%–4.0% | Lower expected future returns (low bond yields, expensive stocks) reduced the sustainable withdrawal estimates. |

| 2020s (recent) | Emphasis on adaptability | No single fixed % | Bengen began arguing for flexible withdrawals — spend more in good markets and cut back in bad markets. |

So his “changing” is not flip-flopping for fun — it reflects different inputs (asset mix, valuations, bond yields) and modern caution about lower future returns.

The “flexible withdrawals” problem — theory vs. retiree psychology

In recent interviews Bengen has emphasised a flexible approach: raise withdrawals when markets are strong, cut when markets are weak. Academically it’s sensible — it preserves capital and reacts to reality.

But for retirees this raises real problems:

- Predictability matters more than optimization. Retirees prefer a steady, reliable income to budgeting and planning life. Telling them “cut spending if markets fall” is easy on paper but painful in practice — you cannot easily shrink medical care, a dependent’s education, or recurring commitments because markets fell.

- Behavioral risk: Many retirees panic-sell in bear markets. A strategy that requires frequent adjustments increases the chance of emotionally driven mistakes.

- Practicality: Monthly bills, EMIs, care costs — families need income predictability.

So while flexible withdrawals are a valid tool, they must be used carefully — not as the default approach for retirees who value stability.

Sequence of Returns Risk — the silent danger everyone misses

Sequence of returns risk means the order of investment returns matters when you are withdrawing money. Two portfolios with identical average returns can behave very differently for a retiree, depending on whether the bad years arrive early or late.

Illustration (simple simulation, same average returns but different order):

Assumptions for illustration:

- Corpus: Rs.1,00,00,000 (Rs.1 crore)

- Initial withdrawal: 4% = Rs.4,00,000 each year (for simplicity, we keep withdrawals constant here to highlight the order effect — this isolates sequence risk)

- Average return target across the 10-year window: 6% per year.

We construct two 10-year return sequences with the same average (6%):

- Good-first: big positive returns in the early years, modest thereafter.

- Bad-first: the same returns but in reverse order (big negatives early, big positives later).

Key balances after withdrawals (selected years):

| Year | Good-first balance (Rs.) | Bad-first balance (Rs.) |

| 1 | 1,21,00,000 | 96,00,000 |

| 2 | 1,35,14,999 | 92,00,000 |

| 5 | 1,48,33,519.75 | 81,68,000 |

| 10 | 1,31,30,190.15 | 1,11,96,650.48 |

Interpretation:

- With good returns early you build a buffer; the portfolio grows even while you withdraw.

- With bad returns early you shrink the base and may be forced to cut withdrawals or sell when prices are low. Even if later years are good, the early damage can leave you emotionally and financially worse off.

Lesson: If a portfolio faces severe negative returns early in retirement, withdrawals can do permanent damage. Sequence risk is one of the main reasons to be conservative early in retirement.

Worked example: Rs.1 crore corpus, 6% inflation — 4% vs 3.5% withdrawal

Real retiree concern: how big is the difference between 4% and 3.5%? Even a half-percent sounds small, but it compounds.

Assumptions:

- Corpus = Rs.1,00,00,000 (Rs.1 crore)

- Inflation = 6% annually

- Two withdrawal rules: 4% and 3.5% (first-year withdrawal amounts; each year the rupee withdrawal increases by 6% to keep up with inflation)

Initial withdrawals (year 1):

- 4% – Rs.4,00,000

- 3.5% – Rs.3,50,000

Inflation-adjusted withdrawals (selected years):

We compute withdrawal in year n as initial withdrawal × (1.06)^(n?1).

| Year | 4% path (Rs.) | 3.5% path (Rs.) |

| 1 | 4,00,000 | 3,50,000 |

| 10 | 6,75,792 | 5,91,318 |

| 20 | 12,10,240 | 10,58,960 |

| 30 | 21,67,355 | 18,96,436 |

(Example calculations: Year 10 withdrawal at 6% inflation means multiply initial withdrawal by 1.06^9. For 4%: 4,00,000 × 1.06^9 ? Rs.6,75,792.)

Cumulative nominal withdrawals over 30 years (sum of each year’s withdrawal):

- 4% path – Rs.3,16,23,274 (~Rs.3.16 crore)

- 3.5% path – Rs.2,76,70,365 (~Rs.2.77 crore)

Difference over 30 years: ~Rs.39.53 lakh (? Rs.39,52,909)

What this shows: that modest initial conservatism (0.5% less withdrawal) yields a significantly lower drawdown on the corpus over decades, giving better chance of survival and flexibility against bad returns, higher-than-expected healthcare costs, or longevity surprises.

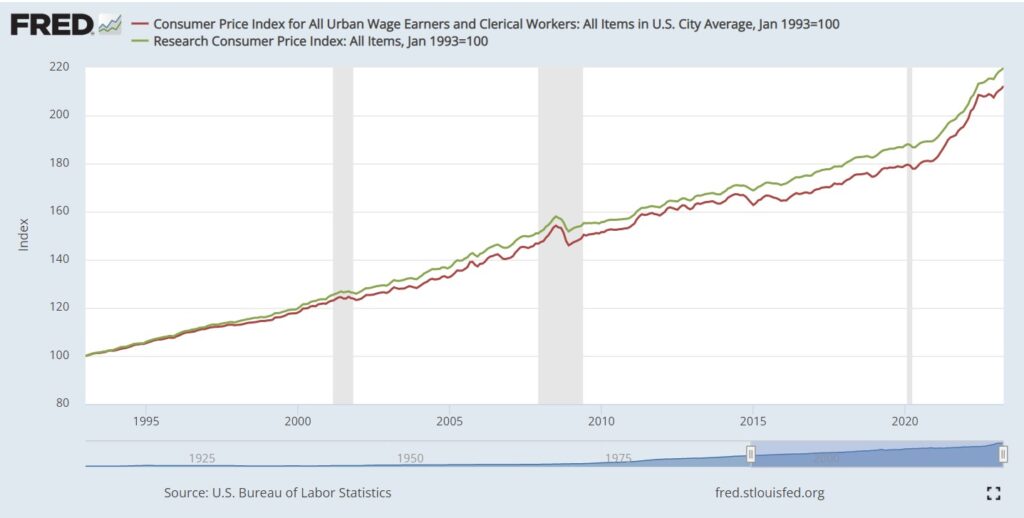

Monte Carlo Simulation: Testing 3%, 3.5%, and 4% Withdrawal Rates in India

When it comes to retirement planning, rules of thumb like the 4% rule can be useful but often don’t reflect Indian realities. To see how safe different withdrawal rates are for Indian retirees, I ran a Monte Carlo Simulation.

What is Monte Carlo Simulation?

It’s a method where we run thousands of “what if” scenarios with different combinations of stock and bond returns. Instead of assuming the market grows smoothly, it captures volatility — the ups and downs that retirees actually face.

Assumptions Used

- Portfolio: 50% Nifty 50 TRI (equity) + 50% 10-Year Government Securities (G-sec)

- Nifty 50 expected return: 10% per year, volatility: 18%

- G-sec expected return: 7.5% per year, volatility: 3%

- Correlation between equity and debt: -0.2 (mildly negative)

- Inflation: 6% per year

- Retirement horizon: 30 years

- Initial corpus: Rs.1 crore

- Withdrawal tested: 3%, 3.5%, and 4% of initial corpus (inflation-adjusted every year)

- Simulations: 10,000 random paths

Results at a Glance

| SWR | 10th Year Median Corpus | 20th Year Median Corpus | 30th Year Median Corpus | 30-Year Survival Probability |

| 3.0% | Rs.1.68 Cr | Rs.2.74 Cr | Rs.4.25 Cr | 96.5% |

| 3.5% | Rs.1.58 Cr | Rs.2.36 Cr | Rs.3.09 Cr | 89.9% |

| 4.0% | Rs.1.49 Cr | Rs.1.97 Cr | Rs.1.95 Cr | 77.7% |

The takeaway: Lower withdrawal rates not only increase safety but also leave behind a much larger legacy corpus.

Chart 1 – Median Corpus Growth Over 30 Years

Interpretation:

At 3% withdrawal, the corpus grows steadily and rarely faces depletion. At 4%, the median corpus stagnates, showing much higher risk of running out of money.

Chart 2 – Probability of Corpus Survival (30 Years)

Interpretation:

At a 3% withdrawal, the portfolio lasts for 30 years in almost 97% of cases. At 4%, it drops to 78%. This difference is huge and shows why “4% rule” may be too risky in the Indian context.

Why This Matters for Indian Retirees

- Volatility tolerance: Western retirees often keep 60–75% in equity even in retirement. In India, most are uncomfortable with that risk, so caution is needed.

- Sequence of returns risk: If a bad stock market hits in your early retirement years, higher withdrawals (like 4%) can destroy the corpus.

- Safer zone: For Indian retirees, 3% to 3.5% withdrawal seems much safer and practical. If you can live with even less, that’s the best insurance against uncertainty.

Disclaimer – The Monte Carlo results presented above are based on historical return assumptions of Nifty 50 TRI and 10-year Government Securities. Actual future returns may differ significantly due to market cycles, interest rate movements, inflation, and economic conditions. These charts show probabilities, not guarantees. Investors should treat this only as an educational illustration and not as personalized financial advice. Always review your withdrawal strategy regularly and adjust based on your actual portfolio performance and spending needs.

Why the U.S. 4% rule is tricky for India (a detailed look)

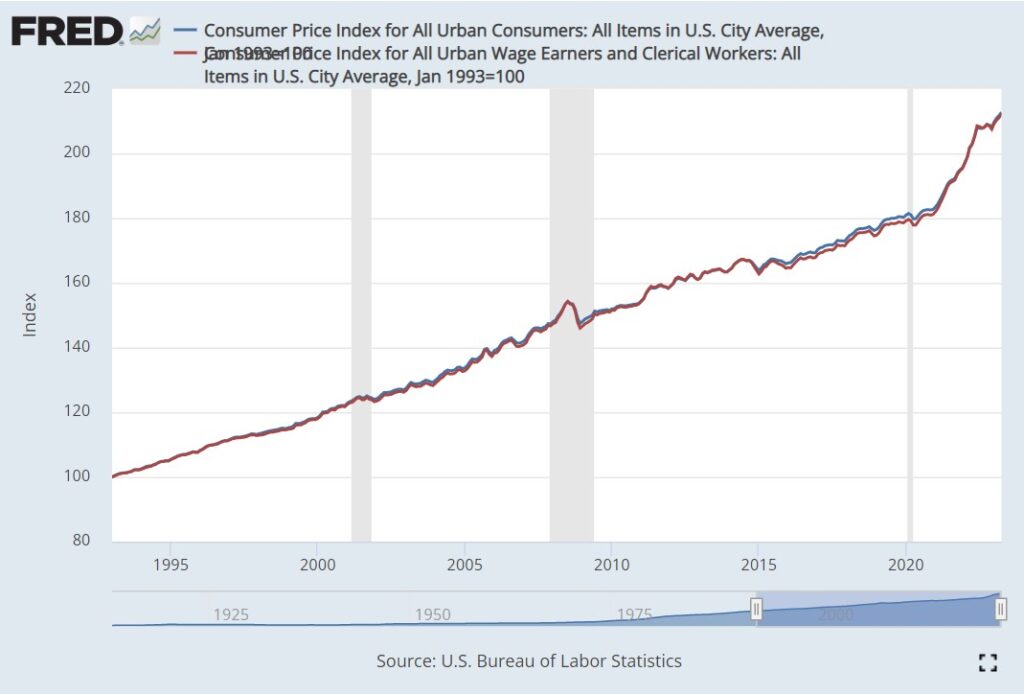

- Higher long-term inflation in India

U.S. historical inflation is ~2–3% (for many decades). India’s long-term average has been higher — often ~5–6% or more. Higher inflation increases future spending needs quickly, meaning withdrawals grow faster in rupee terms. - Different debt market & yields

Bengen’s tests included long-term U.S. government bonds with long, steady histories. India’s debt market structure, tax rules, and yields are different. Predictable long-term “safe” returns like long-duration treasuries are a weaker assumption here. - Equity culture and behavioral comfort

Bengen’s 4% assumptions require holding 50–75% equity even during retirement. Many Western retirees are more comfortable with equities because they have long, multigenerational experience with public markets. Indian retirees are generally newer to equity investing — a 50–75% equity posture during retirement and then seeing a 30% market decline is emotionally brutal. People often sell at the worst time. - Longevity

Indians, especially in urban areas, are living longer. A retirement horizon of 30 years may be too short — more may need 35–40 years of sustainability.

These factors make the 4% rule unreliable as a direct transplant into Indian retirement planning.

Practical, detailed advice for Indian retirees (how to translate this into action)

- Target a conservative SWR: 3%–3.5%

- 3% if you want maximum safety and can accept lower spending initially.

- 3.5% if you want a middle path — reasonable spending now with better odds of lasting.

- 4% should be used only if you are comfortable with high equity exposure and with the emotional stress of volatility.

- Use the bucket strategy (detailed):

- Bucket 1 (0–7/10 years): cash + short-duration debt + liquid instruments — enough to fund near-term withdrawals. This removes the need to sell equities in a down market.

- Bucket 2 (next 10–15 years): blend of debt and moderate equity (25–40%) — aim for some growth while preserving capital.

- Bucket 3 (long term): higher equity (40–50%) for growth to combat longevity and inflation. Move money into nearer-term buckets on a planned schedule.

- Keep guaranteed income where possible

- A small portion invested in annuities or a pension-like product can buy sleep — a fixed floor to meet essential expenses. Even small guaranteed income reduces sequence risk and allows equities to do their job.

- Plan for health inflation separately

- Medical costs often rise faster than CPI. Keep a separate health corpus or make sure health insurance is robust.

- Choose an equity allocation you can emotionally live with

- If you cannot handle 50–75% equity, don’t force yourself for theoretical higher SWR. The benefit of a lower equity allocation is peace of mind; the cost is likely a lower sustainable withdrawal rate — so reduce SWR accordingly.

- Avoid knee-jerk reactions on market swings

- Stick to the plan — but if markets crash and your withdrawals threaten long-term sustainability, reduce discretionary spending (vacations, downscaling luxuries) rather than forced selling of growth assets.

- Review every 2–3 years (not daily)

- Check the plan, not the daily NAV. Use multi-year reviews to make measured adjustments.

- Watch for fees and taxes

- High fund fees and taxes compound the problem. Use low-cost funds and tax-efficient withdrawal sequencing (tax-exempt vs taxable buckets).

Bottom line — the simple sentence to remember

William Bengen gave us a hugely valuable rule of thumb — but even he changed it as markets and data changed. He proved the method (test historically, examine asset mixes), not a single permanent number. For most Indian retirees: aim for a withdrawal rate in the 3%–3.5% range, keep equity exposure at a level you can emotionally handle, use buckets and some guaranteed income, and be conservative early in retirement because sequence risk is real.

And always remember: lower withdrawal = more peace of mind.