A small loan, like a $50 loan, sometimes is all we need for a quick emergency. For example, we might need $50 to fill up our gas tank or to simply to buy food. But you might be asking yourself, “what apps can give me an instant $50 loan?” If that’s the case then, you have come to the right place.

An instant loan is a short term borrowing designed to help you access cash quickly.

Instant loans are different than payday loans, because instant loans are widely available online, while payday loans are typically only available through physical storefront locations.

Using $50 instant loan apps can be safe. However, you need to take some precautions, including making sure the app is reputable.

Here are some 8 popular $50 instant loan apps:

- Brigit

- MoneyLion

- Earnin

- Dave

- Chime

- Varo

- PayActiv

- Branch

It is worth noting that these instant loan apps may offer more than $50. For example, you will find that some $50 loan instant app offers up to $50, while other instant loan apps offers anywhere between $250 to $1000. It is important to carefully review terms and conditions, fees and interest rates before taking out a loan.

What Are Instant Loan Apps?

Before we dig any further on the best $50 instant loan apps, it is better to know the meaning of instant loan apps.

Instant loan apps are mobile applications that allow users to apply for and receive personal loans quickly and easily, typically within a matter of minutes. These apps use technology to automate the loan application process, which reduces the time and paperwork required for traditional loan applications. They also use algorithms to determine the loan amount, interest rate, and loan terms, which are based on the user’s credit score and other financial data.

How to choose the best $50 instant loan apps?

When choosing the best instant loan apps for a $50 loan, consider the following factors:

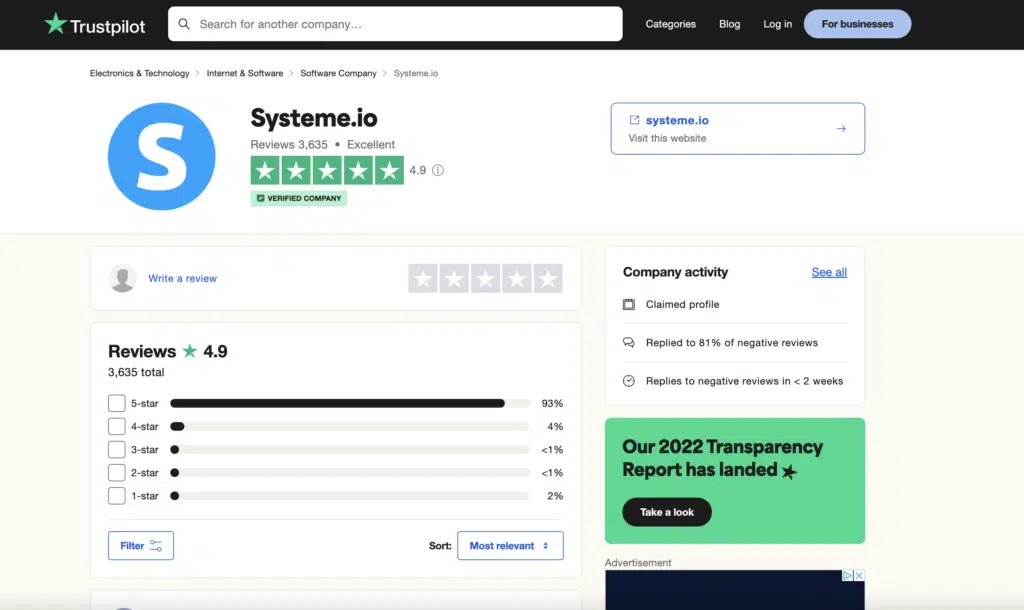

- Reputation: Check the app’s ratings and reviews to ensure it has a good reputation for providing fair and transparent loans.

- Interest Rates: Compare interest rates and fees to ensure you are getting the best deal.

- Eligibility Criteria: Make sure you meet the app’s eligibility criteria, such as minimum credit score, income, and age requirements.

- Loan Amount and Repayment Terms: Consider the maximum loan amount you can receive and the repayment terms, including the length of the loan and the due date.

- Speed: Make sure the app can provide you with the funds you need quickly, within the time frame you need it.

- Customer Service: Ensure the app has good customer service, including accessible and responsive support, in case you have any questions or need help with your loan.

- Security: Check if the app has proper security measures in place to protect your personal and financial information.

It’s important to carefully review all the terms and conditions before accepting a loan to ensure that it meets your needs and that you can comfortably repay the loan in full and on time.

Brigit

The first of the best $50 instant loan apps on our list is Brigit. Brigit is a financial technology company that offers an instant loan app. It provides short-term loans to individuals to help cover unexpected expenses or cash flow gaps between paychecks. The app uses a user’s bank transaction data to assess their ability to repay a loan and provides funds in as little as one business day. Brigit’s loans are meant to be a more accessible alternative to payday loans and traditional credit options.

MoneyLion

MoneyLion is a financial wellness platform that offers an instant loan app for $50 as part of its suite of financial products. The app provides personal loans to help users cover unexpected expenses or take advantage of financial opportunities. Loans are offered with competitive interest rates and flexible repayment terms, and funds can be deposited into the user’s bank account as soon as the next business day. MoneyLion also offers other financial tools and services, such as a robo-advisor, credit monitoring, and cashback rewards, aimed at helping users achieve financial wellness.

Earnin

Earnin is a financial technology company that offers an instant loan app. The app provides short-term loans to individuals, allowing them to access their earned wages before their regular payday. Earnin’s app tracks the user’s work hours and allows them to cash out a portion of their earned wages when they need it, with no fees or interest charged. The company’s mission is to provide access to fair and transparent financial services and to help people take control of their financial lives.

Dave

Dave is a financial technology company that also offers a $50 instant loan app. The app provides short-term loans to help users avoid expensive overdraft fees and get through to their next paycheck. Dave also offers other financial tools and services, such as a budgeting app, savings tools, and overdraft protection, aimed at helping users take control of their finances. The company’s mission is to help people avoid financial stress and live better lives.

Chime

Chime is a technology-driven financial services company that offers a mobile banking app. The app provides a spending account, a debit card, and access to a network of fee-free ATMs. Chime also offers features like early direct deposit, automatic savings, and cash back rewards, aimed at helping users manage their money more easily and make the most of their financial resources. Chime’s mission is to use technology to make banking more accessible, affordable, and simple for everyone.

Chime does not currently offer a $50 instant loan app. However, the company does offer a feature called “SpotMe” which is a type of overdraft protection that allows qualifying Chime account holders to overdraft their account up to $100. This feature is intended to help users avoid costly overdraft fees and keep their account in good standing.

Varo

Varo is a digital banking platform that offers an instant loan app as part of its suite of financial products. The app provides personal loans to help users cover unexpected expenses or take advantage of financial opportunities. Loans are offered with competitive interest rates and flexible repayment terms, and funds can be deposited into the user’s bank account as soon as the next business day. Varo also offers other financial tools and services, such as a high-yield savings account, a budgeting app, and cash back rewards, aimed at helping users achieve financial wellness.

PayActiv

PayActiv is a financial technology company that offers an instant loan app. The app provides access to earned wages before payday, allowing users to avoid costly overdraft fees, payday loans, and other financial stressors. PayActiv integrates with an employer’s payroll system to allow employees to access their earned wages as they work, with no fees or interest charged. The company’s mission is to provide access to fair and transparent financial services and to help people take control of their financial lives.

Branch

Branch is a financial technology company that offers an instant loan app for $50. The app provides short-term loans to individuals, helping them cover unexpected expenses or make ends meet until their next paycheck. Branch uses data science and machine learning to assess credit risk and provide loans within minutes, with competitive interest rates and flexible repayment terms. The company’s mission is to provide access to fair and transparent financial services and to help people take control of their financial lives.

How to get approved for the best $50 Instant Loan Apps?

To increase your chances of getting approved for a $50 instant loan from an app, consider the following tips:

- Meet eligibility criteria: Make sure you meet the app’s minimum age, income, and credit score requirements.

- Keep your finances organized: Make sure you have a stable source of income and keep your finances organized to demonstrate your ability to repay the loan.

- Be transparent: Provide accurate and complete information when filling out the loan application.

- Have a good payment history: A history of on-time payments can help increase your chances of being approved.

- Check your credit report: Review your credit report to ensure there are no errors and to get an idea of your credit standing.

- Be honest: Be honest about your financial situation and explain any potential challenges you may have repaying the loan.

Remember, different apps have different loan requirements and criteria for approval, so make sure to carefully review each app’s terms and conditions before applying. It’s also a good idea to shop around and compare multiple instant loan apps to find the best option for your needs.

Is it safe to use instant loan apps?

Using $50 instant loan apps can be safe if you take certain precautions. Here are some tips to help you stay safe:

- Use reputable apps: Make sure to only use instant loan apps that have a good reputation and are regulated by the appropriate financial authorities.

- Read the terms and conditions: Carefully review the terms and conditions of the loan, including the interest rate, repayment terms, and any fees or charges, to ensure that you fully understand the loan and can afford to repay it.

- Protect your personal information: Make sure to only provide personal and financial information over a secure, encrypted connection and be wary of phishing scams or other forms of identity theft.

- Repay on time: Make sure to repay the loan on time to avoid late fees, interest charges, and potential damage to your credit score.

- Seek help if you have trouble: If you have trouble repaying the loan, reach out to the app’s customer service or a financial advisor for help.

Remember, using instant loan apps is a form of borrowing and should be approached with caution and responsibility. Make sure to only borrow what you can afford to repay and to understand the full terms and conditions of the loan before accepting it.

In conclusion, a $50 instant loan app is a mobile application that provides borrowers with access to small, short-term loans of $50 or less. These loans are designed to be quick and convenient, allowing borrowers to apply for and receive the loan funds within a matter of minutes or hours. The loans are usually unsecured, meaning they don’t require collateral, and are repaid on the borrower’s next payday or within a few weeks.

Instant loan apps use technology to streamline the loan application process, making it easier for borrowers to access funds when they need them. However, as with any loan, it’s important to understand the terms and conditions of the loan, including the interest rate, repayment terms, and any fees, to ensure that you fully understand the loan and can afford to repay it.

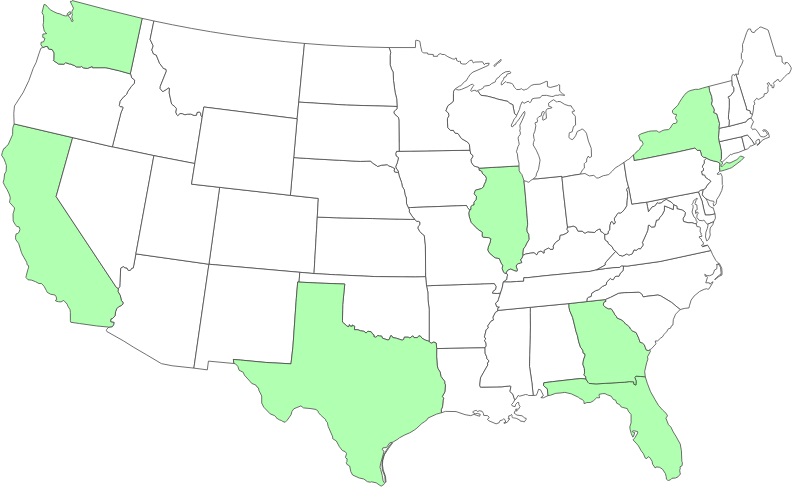

Work With the Right Financial Advisor

You can talk to a financial advisor who can review your finances and help you reach your goals (whether it is making more money, paying off debt, investing, buying a house, planning for retirement, saving, etc). Find one who meets your needs with SmartAsset’s free financial advisor matching service. You answer a few questions and they match you with up to three financial advisors in your area. So, if you want help developing a plan to reach your financial goals, get started now.