People will always be the next big thing.

What do Tom Hanks’s Captain Sullenberger, Sarah Connor, Mad Max, and email marketing all have in common? They’re survivors that defy extinction against all odds.

Representative Maxine Waters (D-CA) has issued a forceful rebuke of two proposed cryptocurrency bills, known as the CLARITY Act and the GENIUS Act: she warned their passage would “open the floodgates to massive fraud” and repeat the deregulatory mistakes that led to past financial crises.

What Happened: In an opinion piece published on Monday, Waters, who represents California’s 43rd congressional district, argued that the crypto bills represent a direct threat to consumer safety, financial stability, and national security.

“What we’re witnessing isn’t just unethical,” she wrote. “It’s the largest fraud and abuse of power in modern history.”

The House is expected to vote on the bills this week. Proponents argue the legislation will create a pro-innovation regulatory framework for digital assets.

But Waters dismissed those claims, contending the bills were “written by and for the crypto industry” and likening them to the Gramm-Leach-Bliley Act of 1999, which dismantled banking safeguards and was later blamed for exacerbating the 2008 financial crisis.

Waters sharply criticized how both bills would constrain regulators from acting preemptively against fraud.

“The CLARITY Act handcuffs the Securities and Exchange Commission,” she warned, claiming it would leave investors exposed until after collapses like FTX have already taken place.

The GENIUS Act, she argued, offers “weak consumer protections” for stablecoin users and provides no meaningful funding for oversight.

She also warned that its provisions enable foreign-controlled crypto operations and fail to guard against national security risks.

Why It Matters: Waters linked the bills to President Donald Trump, claiming they “would legitimize and legalize the unprecedented crypto corruption by the president of the United States.”

According to her statement, Trump has allegedly used his office to strike crypto deals abroad and personally benefited from “shady” ventures, adding $1.2 billion to his wealth through digital assets.

Democrats had proposed several amendments aimed at limiting presidential overreach and improving regulatory safeguards during committee discussions.

Waters said each one was rejected by Republicans.

“These bills will only strengthen Wall Street’s dominance alongside Big Tech, while squeezing out smaller innovators,” she wrote. “They give megabanks and Big Crypto the green light to consolidate control.”

With the 15th anniversary of the Dodd-Frank Act approaching, Waters warned that lawmakers risk repeating history. “Passing the CLARITY and GENIUS Acts would prove that we learned nothing from that disaster,” she said. “If these bills become law, America will eventually face its first crypto financial crisis.”

Read Next:

Image: Shutterstock

July 12, 2025

Spelman and Morehouse alums, Reagan Fresnel and Brian Wright, are introducing students to higher-ed through “Camp HBCYouth.”

HBCU alums are giving Atlanta campers an early taste of college life at an HBCU-led summer camp, Capital B Atlanta reported.

Camp HBCYouth was designed to spark interest in historically Black colleges and enhance academic skills. The program offers affordable access and “camperships” for underserved families, said Reagan Fresnel, founder and Spelman alum.

Fresnel recalled attending a summer program at Morgan State and wanting to bring that experience home. Along with Morehouse alum Brian Wright, that is exactly what she did.

“Only 5% of Black children attend summer camp, so we are carving out space for our students,” Fresnel said to Capital B Atlanta.

She described the camp as a pipeline into HBCUs. HBCYouth strives to instill college values like legacy, community, and excellence in students early in life. To that end, the camp currently serves elementary school students.

Camp counselors are current HBCU students or graduates. At a July 3 field day held at Morehouse’s football stadium, campers took part in tug-of-war, water games, and football training led by NFL cornerback A.J. Terrell Jr. of the Falcons, sponsored by his foundation.

At the West End Spelman campus on July 9, elementary-aged girls painted a mural under the guidance of HBCU students. The camp integrates STEAM, Black history, wellness, sports, and academic enrichment aimed at preventing summer learning loss. Campers received lessons in budgeting, literacy, and tennis lessons licensed through a partnership with the USTA. Each site serves 60 to 70 children, and organizers say nearly 1,000 students have participated since the program began.

Lauren Reed, Camp HBCYouth’s director of marketing, said that hiring HBCU students provides younger campers with mentors who look like them and reflect college success.

“We want them to see people they can look up to,” she said. Spelman senior Skylar Sanford, working as a counselor, said she saw her role as mentorship and sharing joy.

Supported in part by Walmart and Amazon Access, Camp HBCYouth also offers meals to combat food insecurity and maintains a tuition of around $250 per week. Fresnel said the founders are exploring expansion to all HBCUs, extending programming from elementary to high school age to build a sustained pathway into college.

Founded in 2021 by Spelman alums Fresnel and Wright, Camp HBCYouth offers a seven-week day camp on four HBCU campuses—Spelman, Morehouse, Tennessee State, and Clark Atlanta.

Atlanta’s robust HBCU presence—driven by the Atlanta University Center, the nation’s largest HBCU consortium—provides a rich cultural backdrop for this initiative . Camp HBCYouth aims to reinforce that legacy and ensure Black youth have early exposure to environments that reflect their potential and aspirations.

RELATED CONTENT: Georgia HBCUs Are Helping Displaced Students Impacted By Job Corps Shut Downs

Opinions expressed by Entrepreneur contributors are their own.

Your business reputation is more than a feel-good factor — it’s a strategic asset that can propel or derail your growth. One misstep, like a scathing review or a breach of trust, can erode customer confidence, weaken your search engine rankings and stifle referrals.

Conversely, a reputation rooted in integrity can attract loyal clients, inspire your team and fuel organic expansion. As a business owner, actively shaping a trustworthy reputation isn’t just wise — it’s essential for long term success. Here’s how to build a reputation that opens doors and creates opportunities.

Related: The One Mistake Is Putting Your Brand Reputation at Risk — and Most Startups Still Make It

A strong reputation starts with values that guide every decision. At my digital marketing agency, our commitment to integrity shapes how we operate, even when it demands tough choices. For instance, we once ended a contract with a high-paying client who consistently disrespected our team, violating our principle of fostering a positive workplace. The financial hit was significant, but the decision strengthened team trust and reinforced our culture. By defining clear values — such as respect, honesty or excellence — and consistently upholding them, you signal to clients and employees that your business stands for something enduring, laying the foundation for a respected reputation.

Encounters with dishonesty, like a client dodging payment or a partner undermining your business, test your commitment to integrity. Early in my career, I connected a client with a contact who later took their business without acknowledgment. Instead of reacting with anger, I chose to move forward, trusting that new opportunities would emerge. This approach, rooted in an abundance mindset, preserves your professionalism and safeguards your reputation. When faced with betrayal or conflict, prioritize your values over short-term wins. By taking the high road, you earn respect from peers and clients, enhancing your standing as a principled leader.

Related: How to Better Manage Your Brand’s Reputation in the Digital Age

Referrals are a powerful driver of reputation, turning satisfied clients into advocates who bring in new business. Delivering exceptional service to every client maximizes the chance they’ll recommend you to others. Equally important is referring prospects to trusted colleagues when their needs don’t align with your expertise.

For example, directing a client to a better-suited provider may forgo immediate revenue, but it builds goodwill and often leads to reciprocal referrals. Cultivate a network of reliable partners to create a mutually beneficial referral system. This approach not only strengthens your reputation as an honest business but also fosters a cycle of trust that fuels growth.

Online reviews shape how customers and search engines perceive your business, directly impacting your SEO and credibility. Proactively encourage satisfied clients to leave detailed Google reviews, aiming for at least two per month to maintain a robust online presence.

Providing a direct link simplifies the process, and asking clients to describe their experience incorporates keywords that boost search visibility. Respond to every review — express gratitude for positive feedback and address negative ones with a sincere apology and a commitment to make things right. This engagement demonstrates your dedication to customer satisfaction, reinforcing a reputation for responsiveness and care.

A stellar reputation isn’t built overnight — it’s the result of consistent, value-driven actions across all facets of your business. From treating clients with respect to fostering a supportive team environment, every interaction contributes to how others perceive you. Upholding integrity, even when it requires sacrifices like turning away a lucrative but toxic client, creates a ripple effect of trust. This trust translates into loyal customers, motivated employees and a stronger online presence, all of which drive opportunities. To start, choose one actionable step — requesting a client review, refining your referral process or clarifying your values with your team — and implement it this week.

Your reputation is a living asset that grows with every principled decision. Begin by integrating these strategies into your daily operations: define your values, handle conflicts with grace, nurture referrals and prioritize reviews. These steps don’t require a massive overhaul, but their impact compounds over time, positioning your business as a trusted leader.

Tech companies like yours must move smart today to meet customers’ expectations of instant, seamless interactions across SMS, voice, video, and chat. (more…)

As a marketer, I work extensively with multiple cloud-native applications, and my workflow often feels fragmented. (more…)

KULR Technology Group, Inc. KULR saw its stock move higher on Tuesday after announcing a new $20 million credit agreement with Coinbase Credit, a lending subsidiary of Coinbase Global Inc. COIN.

The facility, structured as a multi-draw loan, gives KULR Technology immediate access to capital secured by its Bitcoin BTC/USD holdings.

The company plans to use the funds to further its Bitcoin acquisition strategy, highlighting a deepening commitment to digital assets amid its broader energy management mission.

Also Read: Coinbase Stock Is S&P 500’s Best Performer For June: How It Got There

The credit facility allows KULR Technology to tap up to $20 million without diluting shareholder value. The company labeled this its first Bitcoin-backed credit agreement and emphasized the favorable terms of the deal.

According to CEO Michael Mo, the agreement offers “non-dilutive capital at a competitive financing rate,” helping KULR Technology pursue long-term growth while safeguarding equity interests.

KULR Technology had previously selected Coinbase’s Prime platform in 2024 for crypto custody and wallet services. That move aligned KULR Technology with the majority of public companies holding Bitcoin on their balance sheets.

The funds drawn from the facility will be collateralized with a portion of KULR Technology’s current Bitcoin holdings.

The company has been steadily positioning itself as a “Bitcoin First” enterprise, blending its clean energy technology roots with blockchain-based financial strategies to broaden both reach and revenue channels.

Price Action: KULR shares are trading higher by 6.89% to $6.931 at last check Tuesday.

Read Next:

Photo by Rido via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The EOFY for first time business owners means the first time you will need to submit your financial information to IRD. This means supplying all your financial information to your accountant (if you have one) or to collate this yourself to file in your tax return to submit. .

Given the intricacies of tax law we recommend that you consult a qualified advisor. As no one expects first-time business owners to understand all the relevant legislation well enough to get everything right the first time. Accountants can save you from making costly mistakes and supplying the wrong information to IRD. They can also ensure that you have claimed all appropriate expenses for your business.

The NZ income tax year starts on the 1st April and will run through to 31st March. If you are registered with a tax agent (accountant) you will normally get extension of time this allows for your tax return to be filed by the 31st March the following year. E.g. for EOFY ended 31 March 2020 your return would need to be filed by 31 March 2021. If you are not registered with a tax agent your returns will need to be filed by the 7th June. E.g. EOFY 31 March 2020 your return will need to be filed by 7th July 2020.

Using a cloud-based accounting software does a lot of the work for you, saving you a lot of stress, and makes it easier for your accountant to access your information. It provides a place to save all your invoices, receipts, wages records and asset registers. It also helps to calculate your GST if you are registered also gives you a clear picture of your cash flow, profit & loss and balance sheet. Check out my other articles to see a comparison of accounting software (Xero, MYOB, quickbooks, invoiceninja) and other helpful apps like Hubdoc.

Ensure that you have backups of your files as hardware can be corrupted especially if you are using a desktop based system.

By using an accounting system this not only gives you a real time view of your business, it also means at the end of the financial year you will be able to work out your business and personal income tax. This will also help to determine if you are due to pay provisional tax the next year.

An accountant can easily do this for you however if you want to DIY your return IRD has a range of calculators to simplify this process.

You can claim back any business purchases you’ve made throughout the year. This can include costs such as rent, power and internet for any home office space you’ve used to work from, travel for business purposes, office equipment, motor vehicle expenses and or anything you’ve personally paid for that went towards running your business.

Remember not to claim back any personal expenses against your business. Check out the article on business expenses to ensure that you are claiming all the business expenses you can.

End of Financial Year is also a great time to ensure all your accounts are up to date and ready to send to your accountant. The faster you have the information in the faster you should get your results back. Once you’ve got your file ready for your accountant you can then take a minute, relax and then get ready for the new financial year ahead.

July 6, 2025

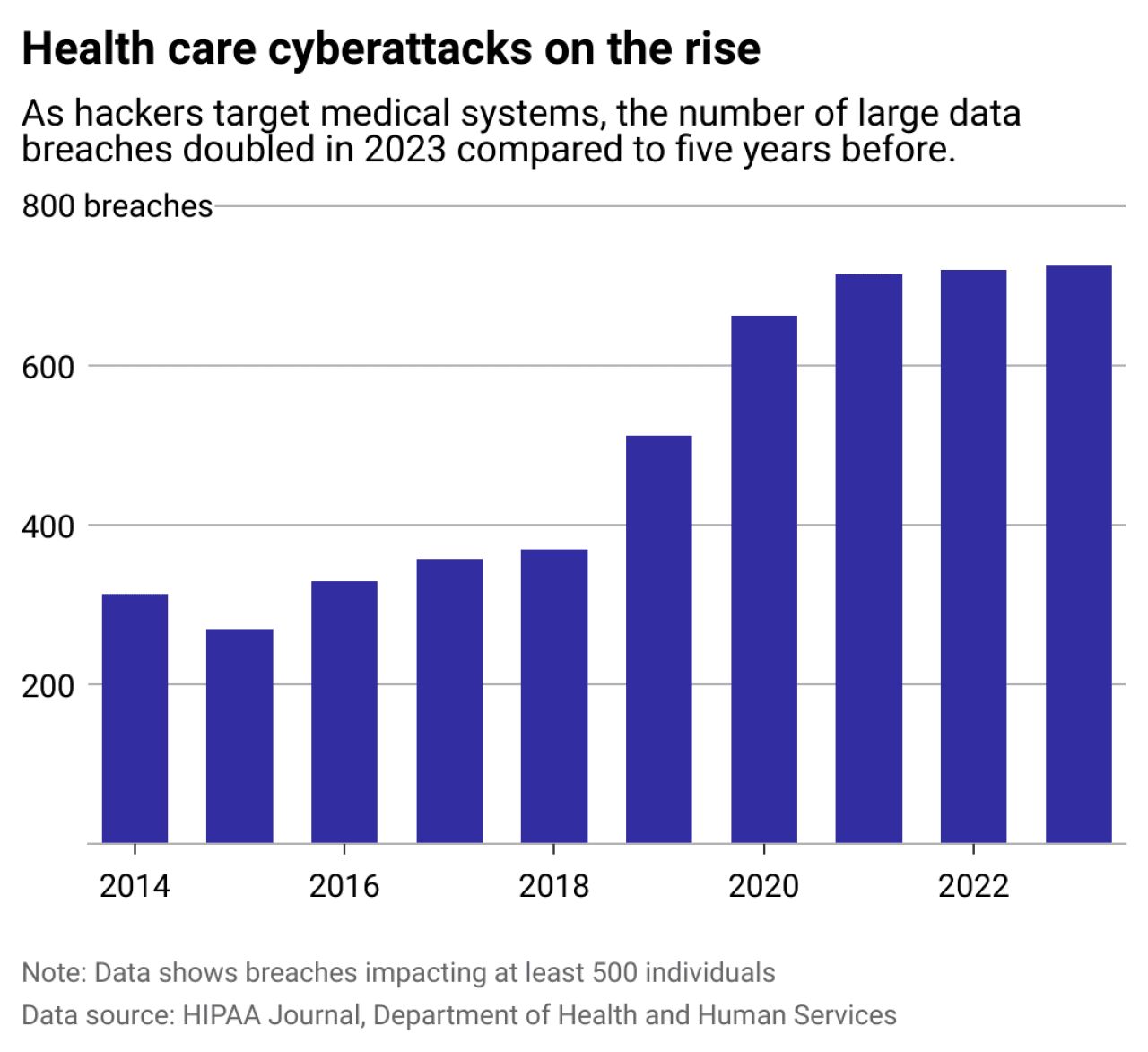

Free NPI Lookup examined data from the Department of Health and Human Services and other sources to explore health care data breaches.

A wealth of information, including Social Security numbers, birth dates, and health insurance details; a reliance on systems connected to the internet; and weak protections. It’s easy to see why health care institutions are such enticing targets for hackers, and they are rising to the challenge.

With that in mind, Free NPI Lookup examined data from the Department of Health and Human Services and other sources to explore the scale of health care data breaches over the last decade.

In 2023, there were 725 large data breaches at hospitals and other organizations, breaking the record 720 breaches the year before, according to a January 2024 report from The HIPAA Journal. In addition, over 133 million records were compromised, more than double the number from the previous year. The problem has become so dire that more than 370,000 records were breached daily in 2023.

What makes health care so attractive to hackers? The stakes.

Should a hospital or other institution be the subject of a ransomware attack, where hackers disrupt operations until they receive a payoff or ransom—patients might suffer or even die. Think of delayed procedures, diverted ambulances, and electronic monitoring equipment going offline. The human cost makes agreeing to hacker demands tempting, even if the FBI advises against it, such as in the case of Change Healthcare, which allegedly paid $22 million in ransom, according to Wired.

Not only is the information valuable, but detection can take a while. As the HIPAA Journal noted, health care data can be used fraudulently for a long time before it is detected. Credit companies constantly monitor unusual spending patterns and can quickly close an account, but health care data cannot be changed so easily. It may also be bundled with other information and sold to identity thieves.

The HHS calls hacking and ransomware “the primary cyber-threats” to the health care sector. They are becoming more frequent and more sophisticated as the industry relies heavily on digital technology, whether electronic records, telehealth, internet-connected devices, or connections to insurance companies and vendors. Older equipment might be incompatible with security measures but too expensive to replace.

In 2023, ransomware attacks against the health care sector worldwide nearly doubled over the year before, according to the Office of the Director of National Intelligence. There were 389 victims in 2023 compared with 214 in 2022. Over the past five years, large breaches involving hacking increased 256% while ransomware shot up 264%, according to the HHS. Attacks can affect millions in one fell swoop.

Among the recent large breaches involved the Kaiser Foundation Health Plan and its 13.4 million members. What Kaiser Permanente described to TechCrunch as “online technologies” installed on its website and applications manifested into members’ searches being forwarded to the likes of Google, X (formerly Twitter), and Microsoft. No Social Security numbers, financial information, or credit card numbers were shared, the company told the Los Angeles Times, but IP addresses—which identify a particular computer—might have been.

Concentra Health Services, in contrast, affected about 4 million individuals, a third as many people as Kaiser Permanente’s breach. The company used a medical transcription company called Perry Johnson & Associates, which was hacked in 2023 and already compromised about 9 million at the time. Patient data divulged included names and addresses, birth dates, Social Security numbers, and other information.

A&A Services, which does business as Sav-Rx, appears to have paid a ransom when it was hit with ransomware, according to The HIPAA Journal. The journal based that assessment on the company’s statement that data taken from its system was destroyed. A&A Services, a pharmacy benefits management company based in Fremont, Nebraska, said it was able to get its systems running the next day with no delay in prescriptions.

Sometimes, not only health care companies but even the affected patients themselves are contacted, as was the case for INTEGRIS Health’s Oklahoma patients. Hackers emailed individuals directly and demanded $50 from each; otherwise, they threatened to sell the data on the dark web. To prove they actually had the data, the hackers included addresses, phone numbers, birth dates, and Social Security numbers in their emails.

The challenges facing the health care industry are significant. Health care breaches remain the most expensive across all industries, according to IBM’s 2024 Cost of a Data Breach report. The average cost of a health care data breach did fall over the last year, from $10.93 million in 2023 to $9.77 million in 2024, but that’s still twice as expensive as the average for all industries.

Critics in the industry say hospitals and other health care institutions are often far behind other sectors in boosting their cybersecurity, even with such simple steps as installing patches for known vulnerabilities. Moreover, financially strapped organizations may struggle to pay for cybersecurity professionals.

What is being done to help the industry tackle the problem? The HHS is trying new requirements balanced by voluntary measures and seeking funds to incentivize hospitals to meet cybersecurity goals. It has proposed rewriting the HIPPA rule—or the Health Insurance Portability and Accountability Act, which requires protecting patient information—to address cybersecurity. It could also tie Medicaid and Medicare funding to heightened cybersecurity, according to the Associated Press.

The Biden administration launched the Universal Patching and Remediation for Autonomous Defense, or UPGRADE, program, to create IT tools that can better fend off cyberattacks in hospitals. It also announced efforts from the private sector.

Microsoft has agreed to provide grants giving smaller organizations up to a 75% discount on security products and free cybersecurity training and assessments for eligible rural hospitals. Google will also provide advice for rural hospitals and nonprofits, as well as discounts for its suite of tools. In the meantime, New York proposed cybersecurity changes for its hospitals and allocating funds to help pay for the improvements.

No matter what, the efforts will need funds. Former health official Iliana Peters told The New York Times, “Without additional resources to raise the bar, those health care providers and those health care payers are going to continue to make choices to pay for treatment or for cybersecurity.”

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story was produced by

The Data Project and was produced and

distributed in partnership with

Stacker.