“I just bought a new BPA-free tupperware set.”

This comment, coming from my friend Anna, caught me off guard.

Anna’s a highly competent law professional. She’s a critical thinker and she fights in the heavyweight division when it comes to cutting through BS.

But the Anna I knew was falling into some painful traps that seemed to be bypassing her inner hawk-like skeptic.

She’s wanted to lose around 15lbs for some time now and came to me to share how stuck she was feeling in this goal.

She brought up an avenue she was exploring: the new BPA-free tupperware set.

“Interesting. What inspired you to focus on that?” I asked.

“Well, I’ve been reading about how microplastics in food containers can mess up our hormones and cause weight gain,” she said.

I squinted.

To backtrack, this is right after she told me how she’d been struggling to be consistent at the gym, had been relying on takeout too often, and had been sacrificing boring old sleep for adrenaline-inducing doom scrolling.

So I asked:

“What about trying to get more consistent with your workouts, or prepping more homemade meals during the week?”

And Anna said:

“Yeah, but I’ve tried that a thousand times. If it were that simple, it would have worked already.”

We’ve all done this before.

Ignored or delayed those hard-but-worthwhile habit changes in favor of some ultra-specific, niche magic bullet that’s supposed to “change everything.”

Spent hours of research on the ultimate, most optimal workout instead of devoting those hours to just doing the basic workout you already know how to do.

Waited to feel more inspired, motivated, or just less busy.

Why do we do this?

Buying new gear or a popular supplement feels like making progress.

Consuming YouTube videos or articles about stuff you can change feels like you’re doing something.

And waiting until the “right time” feels, well, right.

Except, nothing actually changes until we take real, consistent action.

We’re clever, us humans. And we’ve come up with lots of sneaky ways to avoid the basic, unsexy, difficult actions we need to take that actually drive change.

In this article, we’ll explore how to take an honest and compassionate look at why you might be distracting yourself from taking impactful action.

You’ll learn:

- What the most impactful health habits actually are

- Three common barriers to making sustainable progress

- A 4-step process you can apply to start taking positive, productive action

- How to keep yourself consistent—and achieve your goals

The stuff you know you should do (but probably aren’t doing consistently)

We all know what those basic, fundamental health habits are:

▶ Exercising, ideally 30 minutes a day, putting in moderate-to-vigorous amounts of effort, with a mix of aerobic and resistance training.

▶ Eating mostly nutritious, minimally-processed foods. If 80 percent of your diet comes from whole or minimally-processed foods, you’re doing an excellent job. (Translation: “Perfection” isn’t required; pizza can be part of a healthy diet.)

▶ Eating enough protein to support muscle mass, appetite regulation, and body recomposition goals, if you have them. Aim for about 1.2 to 2.2 grams of protein per kilogram of body weight (for most people, this adds up to about 4-6 palm-sized portions of lean protein per day).

▶ Prioritizing getting seven to eight hours of quality sleep. You can’t always control how well you sleep, but having some wind-down time before bed can help, as can waking up at the same time every day.

▶ Avoiding or at least reducing excessive consumption of alcohol or drugs, including cigarettes. No fun, we know. But it’s for a good cause.

Easily, we could add stuff like prioritizing positive, nurturing social relationships, managing stress, and probably others, but just the above list is uncommonly met.

In fact, only six percent of Americans perform all five of the following basic health behaviors:1

- Meet physical activity recommendations

- Don’t smoke

- Consume alcohol in moderation (or not at all)

- Sleep at least seven hours

- Maintain a “normal” BMI

If you’re doing the math, that means close to 94 percent of Americans aren’t doing the basics.

Yet, these foundational behaviors also help us achieve a long list of common goals, whether that’s reaching a healthy weight, improving athletic ability, or just living a longer, healthier life.

So why do we struggle so much to do them?

Here are three common barriers we see among clients (and coaches!), plus potential solutions to overcome them.

By the way, ambivalence is normal.

That push-and-pull feeling you have when you think about making a change?

It has a name, and it’s called ambivalence.

Ambivalence describes the mix of feelings you have when you contemplate, say, waking up earlier so your mornings are less stressful, or cutting down on TV time.

We naturally and normally feel ambivalence about change—“I want this, and at the same time, that.”

(For example, wanting to eat healthier, and also wanting to have your favorite treats whenever you want without constraint.)

We also naturally and normally feel resistance towards change—“I want this, and at the same time, not.”

(For example, wanting to stop using your phone as a mindless distraction, but not wanting to deal with the anxiety you get whenever you’re left with your own thoughts.)

These contradictory emotions can seem frustrating, puzzling, or “illogical.” Yet, ambivalence and resistance are fundamental parts of the change process.

The higher the stakes of change, the more likely we are to feel a mix of strong and unexpected emotions, pushback, rebellion, angst, and other types of resistance and ambivalence.

Rather than signaling that the change is a wrong move, strong ambivalence and resistance tend to signal that this change matters to us.

In a sense, it’s good news.

It tells us we care.

Basics Barrier #1: You have ambition overload.

Maybe you’ve decided you want to be healthier. So you declare that, starting Monday, you’re going to exercise for an hour everyday and “eat clean” at every meal and sleep eight hours every night.

(Currently, you don’t have a regular exercise habit, don’t particularly like vegetables, and regularly stay up past midnight.)

Now, let’s be honest: You’re asking yourself to change a lot of stuff at once.

And the last time you created an elaborate plan for overhauling your life…

… Did it work?

Probably not.

(And that’s okay.)

When we feel frustrated or stuck in our current situation, making a plan filled with idealistic dreams can provide us temporary relief.

And our brain has several (normal) cognitive biases that prevent us from judging the future accurately.

We often think we’ll have more time, energy, attention, and motivation in the future than we really do.2 3 4 5

There’s a powerful, instantaneous comfort that comes with overloading our future self. (Because after all, we won’t start the plan until Monday.)

The problem with this is:

Big, complex plans often don’t fit into our already busy, complex lives.

We under-estimate how many smaller tasks are hidden in the bigger plans.

When we (almost inevitably) are unable to execute these ambitious goals, we blame ourselves, our personality traits, our “willpower” or “discipline,” and build a pitiable story about how we “struggle with consistency.” Or how living this way is “impossible”.

Then, sadly, we fulfill that prophecy.

Basics Barrier #2: You think only hardcore, “industry-secret,” or “cutting-edge” stuff works.

This barrier comes from the following common belief:

“If getting healthy just took eating, sleeping, and exercising moderately well, then everyone would be healthy.”

Because everyone knows they should eat their vegetables, get seven to eight hours of sleep per night, and stay active, right?

(We’d agree.)

But let’s go back to the previously mentioned statistic:

Only 6 percent of Americans are consistently performing the most basic health and fitness behaviors.

If we add on slightly more advanced—but still very basic—behaviors like eating five servings of fruits and vegetables every day, optimizing protein intake, and effectively managing stress, that number would shrink significantly.

So, the first thing is to believe that these simple behaviors work. Because they do. It’s just that most people (probably close to 99 percent of us) are not doing them all simultaneously and consistently.

The second thing is to accept that these simple behaviors are a little bit boring. Because they are. Part of the reason we’re attracted to new diets or “magical” supplements is because we just want something more interesting to try.

That’s especially true if we’ve already sort of tried the “eat more vegetables” thing and it didn’t “work” for us in the way we expected.

With something new and cutting-edge, there’s also the possibility of a new outcome, a new us.

And of course, that’s incredibly appealing.

Thing is, most hardcore, “industry secret,” or “cutting edge” tools and strategies are, respectively: unsustainable, inaccessible, or ineffective (or unproven).

They’ll take your effort, your time, and often your money, but without giving you a good return on your investment—all the while distracting you from the stuff that actually works.

Basics Barrier #3: You think your efforts (and your results) have to be perfect.

Another lie in the health and fitness industry is that you have to be “perfect” to maintain great health. You know, eat only organic salads and chia seeds, be able to run a marathon, and wake up at 5 am every day to meditate and write in your gratitude journal.

The truth is, perfection definitely isn’t required.

Depending on how you look at this, this could be a relief to hear, or a disappointment.

On the one hand, it’s nice to know that you don’t have to have it “all together” to be healthy—even above-average healthy.

On the other hand, many of us pursue better health with the belief that our optimal or even “perfect” self will one day, with the right plan or routine, be attainable.

But “perfect” health is an illusion.

Humans, even exceptionally healthy ones, get sick, get weird rashes, have digestive problems, need reading glasses, get into slumps, or just otherwise have a series of bad days.

None of us are “safe” from those life events, and accepting that can feel a little… vulnerable.

It’s much more comfortable to believe that if you just take this powdered algae supplement, or follow this specific morning routine, you’ll be immune to any kind of painful human experience.

The irony is, to achieve your realistic “best self,” you probably have to accommodate your “worst self” too. You know, the one who’d rather watch another episode of Love is Blind than work out, or eat a party-size bag of Doritos and call it dinner.

Because life happens.

Work gets busy.

Or your kid goes through a “phase.”

Or it’s pie season.

Any number of obstacles, distractions, and competing demands make it impossible for perfection to be maintained with any kind of consistency.

Which is why we need to let go of the illusion that a “perfect” self exists—the one who always has the energy, will, and option to make the ideal choice—and support what our real self wants and needs.

We’ve got four steps below to help you.

4 steps to start taking effective (and realistic) action

Now that we know what’s potentially getting in the way of taking productive action, here are four steps to get unstuck.

Step #1: Explore the why before the how.

Before you (or a client) start undertaking something you want to change, it’s helpful to understand your deeper motivations first.

Do a little investigating by asking questions like:

- What about this change is important to you?

- How serious or pressing is this for you?

- Why not continue doing what you’re already doing?

You can also go through one of our favorite motivation-mining exercises, The 5 Whys.

When you know why you want to change something, and you’re clear on the consequences of not taking action, you’ll be more likely to feel that deeper, more sustaining push to keep going, even when things get tough.

Step #2: Prioritize the most effective actions.

We can do all the things!! Really!! We just can’t do all the things… all at once.

Effective change means being able to realistically:

- Identify all the tasks, trade-offs, and commitments involved

- Prioritize what matters for the results you want

- Figure out what to do first

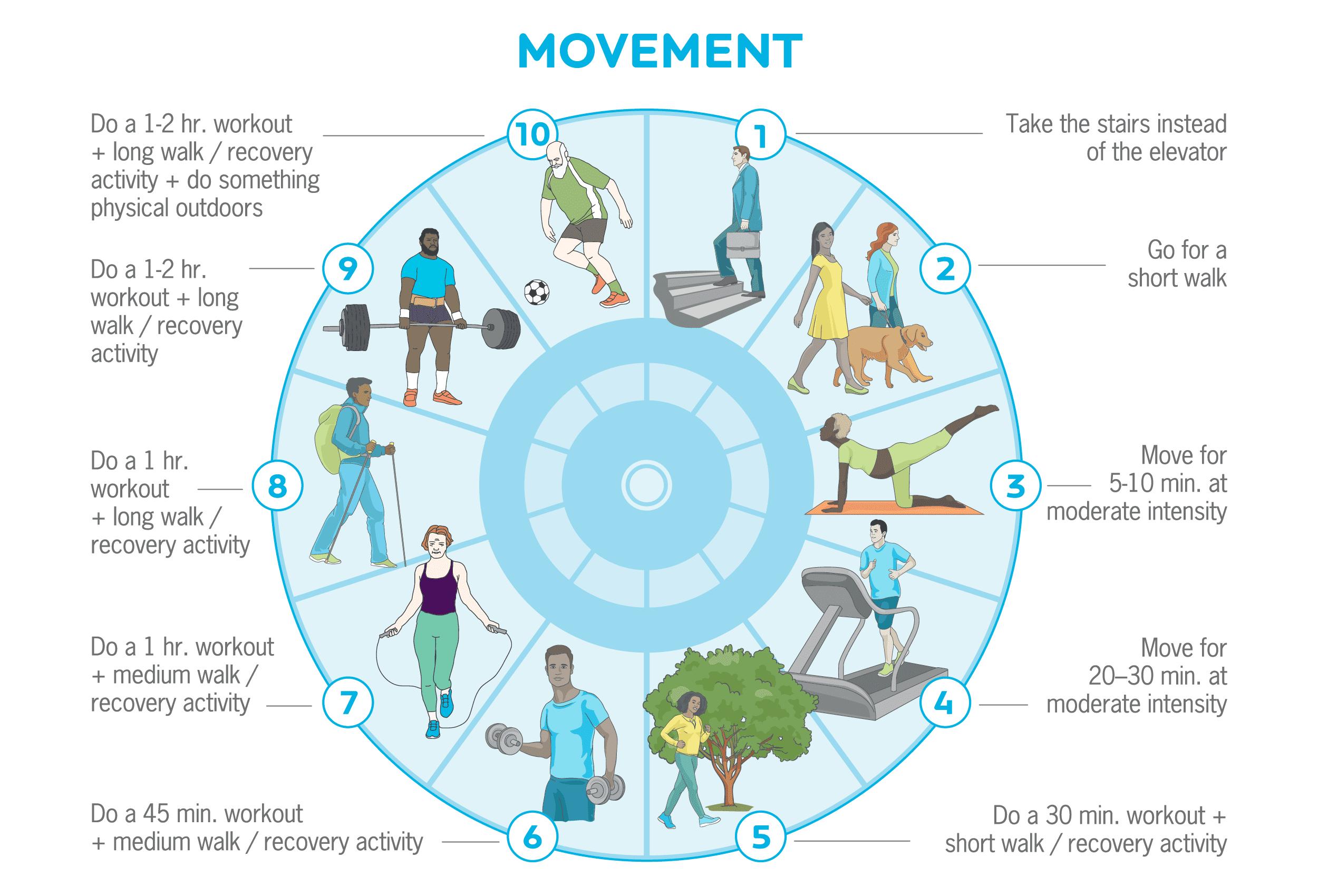

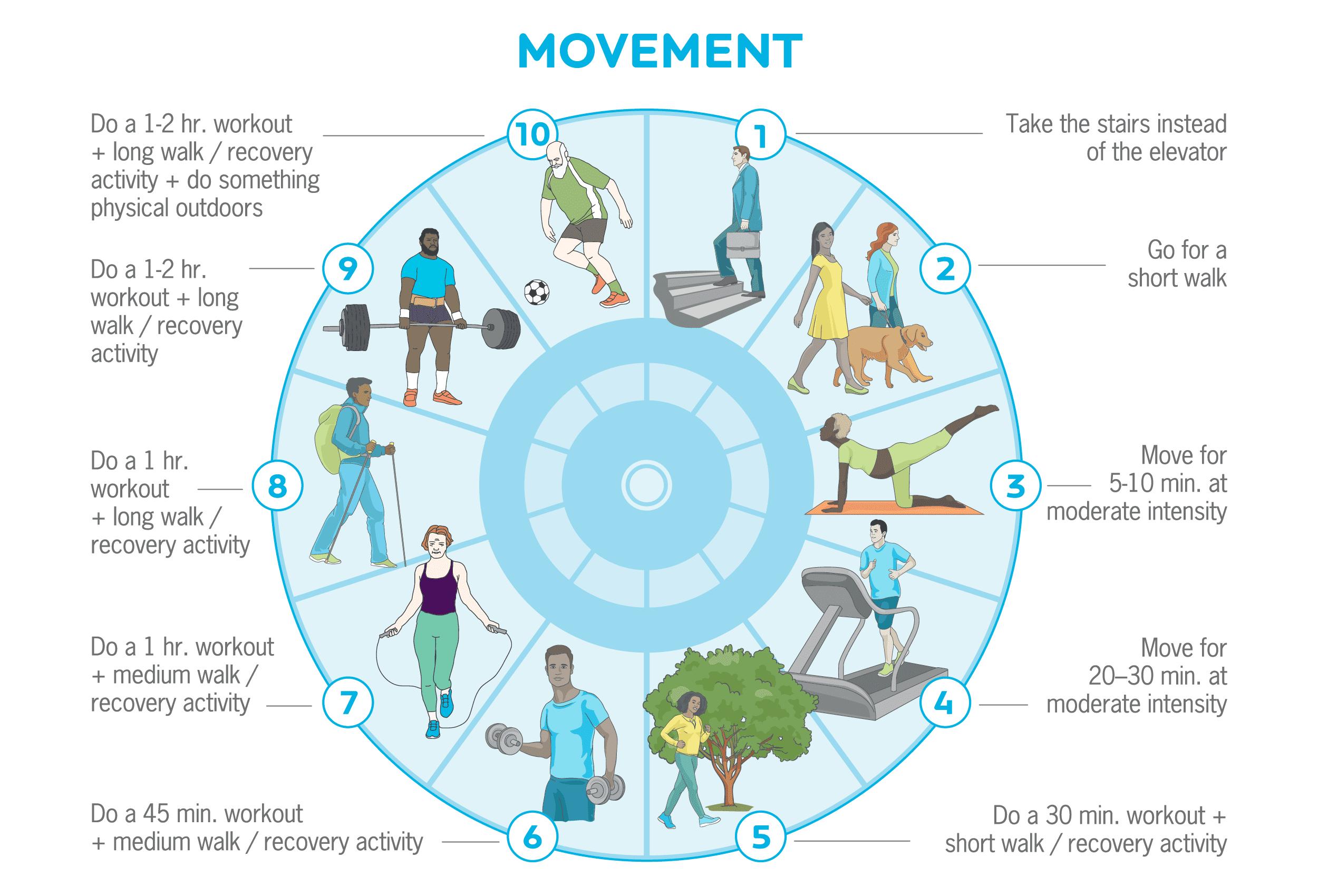

What are the essentials in relation to your goal? Regardless of all goals, they likely include a movement practice, a nutrition practice, and/or a recovery practice.

If you want some guidance on how to select the most effective action for your goal, check out our Skills, Practices, and Daily Actions Cheat Sheet.

Here’s how to use it:

▶ Start with the domain you’re most interested in improving (such as “Nutrition” or “Stress”).

▶ Then, get specific about what skill within that domain you’d like to improve (for example, “Eat well intuitively”), plus the practice that most appeals to you within that skill (say, “Eat to satisfied”).

▶ Lastly, choose a daily action from the list of examples under your chosen practice. (For example, “Record hunger and fullness levels at the start and end of meals.”)

Once you choose your action, make it work for you by following step 3, below.

Step #3: Make sure you can take action, even on your worst day.

“I like to challenge a client to set a pathetic goal. If it’s so pathetic, then obviously you can do it, right?” says Kate Solovieva, PN Super Coach and Director of Community Engagement.

Sound inspiring?

Maybe not.

But if you’ve been struggling with consistency, it’s exactly where to start.

Ask yourself:

- What can I do on my absolutely worst day where everything goes wrong? How much time, effort, or enthusiasm will I realistically have?

Five minutes of walking? 10 push-ups? One extra portion of veggies? Three conscious deep breaths before every meal? Nothing is too small; it just has to be something.

Now you’ve got your floor.

Then ask yourself:

- What can I do on my best day, when I feel on top of the world and circumstances are on my side? How much time, effort, or enthusiasm will I realistically have?

One-hour of all-out effort at the gym? Two hours of meal prep that will feed you and your family for the next three days? A 45-minute guided meditation?

This is your ceiling.

Now that you’ve identified your “floor” and your “ceiling,” you’ve defined a flexible range of actions that can adapt to your fluctuating, unpredictable, real life.

But applying this range requires a paradigm shift:

Your health habits aren’t an “on” or “off” switch; they’re on a dial.

When life is sweet and smooth, you can turn your exercise, nutrition, and sleep dials way up—if you want. Bust through your PRs at the gym, eat all the arugula, meditate like a monk.

But if life gets nuts, you don’t have to switch off completely.

Just turn the dial down a little.

The below is a visual representation of how this might work for exercise, but you can apply this same thinking to your nutrition, sleep, stress management, or whatever you’re working on.

The important part: Even if you do your “floor” or “dial level 1” action—even if it’s for days on end—it still “counts.”

You still get the gold star.

Doing the bare minimum isn’t failing.

It’s succeeding, in the context of a real, messy, beautiful life.

Step #4: Create an ecosystem that supports you.

Health and fitness professionals often forget how different their lives are from their clients.

For example, many coaches work at gyms, enjoy being physically active, and hang out with other active people. Exercising regularly is almost easier to do than not do, because, as Coach Kate says, “they’ve built a life that makes that habit seamless.”

So if you want to make your health goals more likely, Coach Kate offers this advice:

“Build an ecosystem that makes failing nearly impossible.”

When they want to make a change, many people assume that good intentions and willpower will be enough to carry them through. (And when they fail, naturally, they blame themselves for being “bad” or “weak.”)

We often forget about the context and environment that shapes our behaviors—making certain actions more likely or less likely to occur.

A recent review from Nature Reviews Psychology ranked different behavior change strategies and found that access was the number one influencer of people’s behaviors. (People who lived in neighborhoods with affordable grocers close by ate better, just like people who had to drive a long distance to the closest gym were less likely to exercise.6)

Not everyone can change neighborhoods, but most people have some degree of control over their more immediate environments, and can leverage this power to shape desired behaviors.

One example is the “kitchen makeover,” where you make sure foods you want to eat are washed, prepped, and at the front of the fridge, ready to eat on a whim. Meanwhile, foods that don’t support your goals get tossed, or relegated to the highest cupboard. (When you need a stepladder from the basement to reach the cookies, you might find you eat them less.)

(If you want to try it out, check out our Kitchen Set-up Assessment worksheet.)

Think about the goal you want to achieve, and the behaviors that support it. Then, evaluate how you might make small changes to your environment by:

- Using a trigger: Sometimes called a “cue” or a “prompt,” a trigger is simply a reminder to do a desired action. For example, you might block the door of your home office with a kettlebell, reminding you that, every time you leave or enter the office, you have to do ten kettlebell swings. If you’re trying to cut down on mindless phone time, you can install an app that reminds you to shut things down after 20 minutes on social media.

- Decreasing “friction”: Supermarkets put candy next to the checkout, making it easy to slip that chocolate bar into your cart while you’re standing in line, likely bored and hungry. You can be equally sneaky about encouraging positive behaviors too, such as putting fruit on your counter, ready for a quick snack, or packing your gym bag the night before, so it’s ready to grab on your way out the door before you change your mind.

- Constraining available options: Whether it’s deleting time-sucking apps off your phone, removing foods you know you lose control around from your kitchen, or heck, creating a capsule wardrobe so you waste less time in the morning getting dressed, constraint can actually free up a lot of time, brain power, and energy.

Invest your energy building the ecosystem that nudges you to make desired actions the obvious choice. This requires a little more work on the front end, but the payoff will be greater for less overall work.

Embrace C+ effort.

If you’re a perfectionist, or a former straight-A student, that line hurt to read.

(Don’t worry. This C+ won’t result in your parents telling you that they’re disappointed.)

But what all of the above barriers and solutions have in common, is that they recognize and work with our inherent imperfection.

None of us is perfect, and expecting as much often results in failure (or at best, short bursts of success, followed by a crash).

Adopt an attitude of compassion and acceptance towards your human self—who’s most likely trying their hardest—and work with your vulnerabilities, instead of constantly expecting yourself to grit your teeth against them.

There will be times you’re getting “A’s” in fitness. That’s awesome. And you also don’t need to aim for C+. Just don’t think of yourself as a failure when you have to dial it down.

Living a healthy, meaningful life means constantly striving to do our best—while also allowing for flexibility, mistakes, and bad days (or seasons).

You’ll be surprised at how much better “good enough” is than nothing. Especially in the long run.

References

Click here to view the information sources referenced in this article.

- Liu, Yong, Janet B. Croft, Anne G. Wheaton, Dafna Kanny, Timothy J. Cunningham, Hua Lu, Stephen Onufrak, Ann M. Malarcher, Kurt J. Greenlund, and Wayne H. Giles. 2016. Clustering of Five Health-Related Behaviors for Chronic Disease Prevention Among Adults, United States, 2013. Preventing Chronic Disease 13 (May): E70.

- Buehler R, Griffin D, Peetz J. Ch 1: The planning fallacy: cognitive, motivational, and social origins. In: Zanna MP, Olson JM, editors. Advances in Experimental Social Psychology. Academic Press; 2010. p. 1–62.

- Kruger J, Evans M. If you don’t want to be late, enumerate: Unpacking reduces the planning fallacy. J Exp Soc Psychol. 2004 Sep 1;40(5):586–98.

- Buehler R, Griffin D, Ross M. Exploring the “planning fallacy”: Why people underestimate their task completion times. J Pers Soc Psychol. 1994;67(3):366–81.

- Buehler R, Griffin D, Ross M. Inside the planning fallacy: The causes and consequences of optimistic time predictions. Heuristics and biases: The psychology of intuitive judgment. 2002;250–70.

- Albarracín D, Fayaz-Farkhad B, Granados Samayoa JA. Determinants of behaviour and their efficacy as targets of behavioural change interventions. Nature Reviews Psychology. 2024 May 3;1–16.

If you’re a coach, or you want to be…

You can help people build sustainable nutrition and lifestyle habits that will significantly improve their physical and mental health—while you make a great living doing what you love. We’ll show you how.

If you’d like to learn more, consider the PN Level 1 Nutrition Coaching Certification. (You can enroll now at a big discount.)