As property/casualty insurers increase their focus on predicting and preventing costly damage that drives up claims and premiums, telematics technology has come to play an increasing role. From video doorbells that reduce theft and vandalism to “smart plumbing” solutions that detect leaks and shut off water before in-home flooding can occur, these technologies clearly offer value to homeowners and insurers.

But how much value?

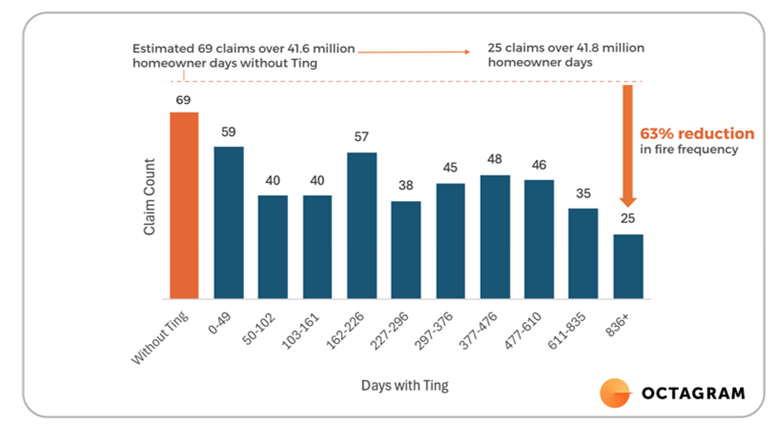

Whisker Labs – maker of the Ting home fire prevention solution – has taken on the challenge of quantifying its product’s efficacy and return on investment. In a research partnership with Octagram Analytics for independent data analysis and modeling and Triple-I for its insurance industry expertise and insight, Whisker Labs found that Ting reduced fire claims within the study sample by an estimated 63 percent, resulting in 0.39 fewer electrical fire claims per 1,000 home years of experience, in the third year after installation. This translates into a fire claims reduction benefit of $81 per customer.

“This study provides concrete evidence of the value that telematics technology can deliver,” said Patrick Schmid, chief insurance officer at Triple-I. “While IoT solutions are gaining traction with many success stories, rigorous analysis of claims reduction has been harder to find until now. This analysis clearly shows Ting reduces claims and provides a positive return on investment for insurers.”

The research can be read here.

How Ting works

Ting helps protect homes from electrical fires by using advanced AI to detect arcing, the precursor to most electrical fires. Once connected to a single outlet, Ting analyzes 30 million measurements per second, analyzing voltage at high frequencies to detect tiny electrical anomalies and power quality problems. These hazards can originate from wiring in the home, connected devices and appliances, or even the power coming in from the utility. On average, Ting detects and mitigates fire hazards in 1 out of every 60 homes it protects.

“Ting is about saving lives and homes – that’s always been our mission,” said Bob Marshall, CEO and cofounder of Whisker Labs. “By analyzing verified claims data over time, this analysis shows that what’s best for families also delivers a strong financial return for insurers. Prevention is better for everyone.”

Whisker Labs works with a growing community of 30 insurers who provide Ting to their customers for free. More than one million Tings are deployed in the United States, and approximately 50,000 new Tings are installed each month.

In addition to monitoring voltage and features of voltage at high frequencies to detect arcing that is indicative of fire hazards, Ting has a temperature sensor that monitors the temperature within the home.

“When the temperature drops below 42 degrees, an alert is issued,” Marshall said. “Thus, Ting detects and warns about conditions that can result in frozen and burst pipes and alerts the homeowner to correct the situation before damage occurs. Over the past three years, we have issued low-temperature warnings to about 1 in 560 customers per year.”

Measuring the value

Like Ting, other peril-based IoT solutions issue alerts and warnings when a hazard is detected. Thousands of hazards are detected and alerts sent, but how do you know that this reduces claims? How do you estimate the return on investment for these devices? How can you prove that the bad thing, a loss and a claim, didn’t occur?

“We developed a methodology to do this in the real world with existing customers and experience data,” said Whisker Labs Chief Scientist Stan Heckman.

Whisker Labs and Octagram had to overcome challenges related to limited data and sampling bias. To address these, a self-controlled study was developed that assesses claims over time in homes with Ting in place. (See paper for a fuller explanation of the methodology).

The chart below shows how the number of fire claims in Ting-equipped homes declines over time. The claims frequencies observed and associated percent reduction in claims are highly dependent on the definition of the sample of non-cat fire claims provided by carriers that participated in the analysis. However, this does not affect the observed absolute reduction.

Using data from Triple-I and Verisk, Whisker Labs determined that Ting provides a loss-prevention benefit of $81 per home per year. (See paper for details).

“Add in benefits associated with reduction in water-related losses from frozen pipes and failing sump pumps and water heaters,” and the benefits are likely substantially higher, Marshall said. Insurers who provide Ting to their policyholders also may enjoy improvements in customer retention.

Learn More:

Human Needs Drive Insurance and Should Drive Tech Solutions

JIF 2024: What Resilience Success Looks Like

Leave a Reply